In the dynamic world of digital banking, Chime has emerged as a significant player, reshaping how millions of users manage their finances. Imagine a platform that eliminates traditional banking barriers while offering seamless, mobile-first solutions. This is Chime’s promise. Over the years, it has disrupted the financial technology space with its user-centric features and steady growth. As we delve into Chime’s milestones and statistics for 2025, we uncover a fascinating story of innovation, inclusion, and market dominance.

Editor’s Choice: Key Milestones

- 18+ million users actively rely on Chime’s services as of early 2025, maintaining its lead among US neobanks.

- Chime processes over $2.1 billion in direct deposits monthly in 2025, reflecting its growing role as a trusted banking alternative.

- 88% of Chime users fall within the 25–44 age group in 2025, reinforcing its dominance among digital-first millennials and Gen Z.

- Chime reported 38% year-over-year revenue growth from 2024 to 2025, signaling sustained expansion amid rising competition.

- As of 2025, Chime remains the #1 US neobank by active users, ahead of rivals like Current and Varo Money.

- In 2025, customer satisfaction with Chime reached 93%, thanks to zero fees, instant notifications, and early paycheck access.

- Strategic 2025 partnerships with DoorDash, Instacart, and Uber strengthened Chime’s position as the preferred bank for gig workers.

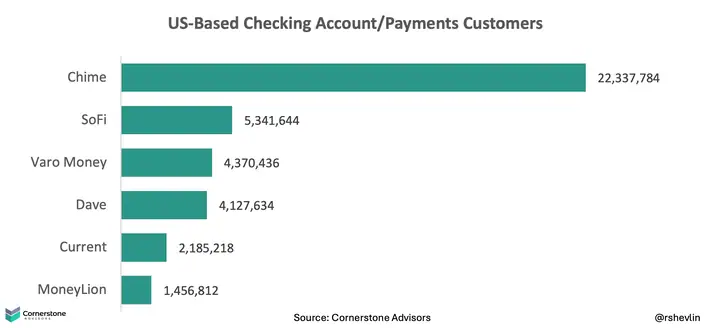

US-Based Checking Account/Payments App Users

- Chime leads the US market with 22.34 million customers, far ahead of any competitor.

- SoFi ranks second with 5.34 million users, showing strong adoption in fintech banking.

- Varo Money has attracted 4.37 million customers, maintaining a solid user base.

- Dave follows closely with 4.13 million customers in the space.

- Current holds 2.19 million users, showing moderate growth.

- MoneyLion rounds out the list with 1.46 million checking/payment customers.

Chime Revenue

- Chime’s revenue surpassed $1.25 billion in 2025, reinforcing its stronghold in the digital banking sector.

- Subscription services like SpotMe generated $410 million in revenue in 2025, reflecting rising user engagement.

- Interchange fees contributed $570 million in 2025, accounting for around 46% of total income.

- Annual revenue growth from 2024 to 2025 stood at 39%, keeping Chime ahead of most neobank rivals.

- Business partnerships and embedded finance integrations added over $200 million in revenue in 2025.

- The average Chime user completed 58+ transactions monthly in 2025, boosting payment-driven revenues.

- Chime officially crossed the $1 billion revenue mark in Q2 2025, solidifying its position as a neobank leader.

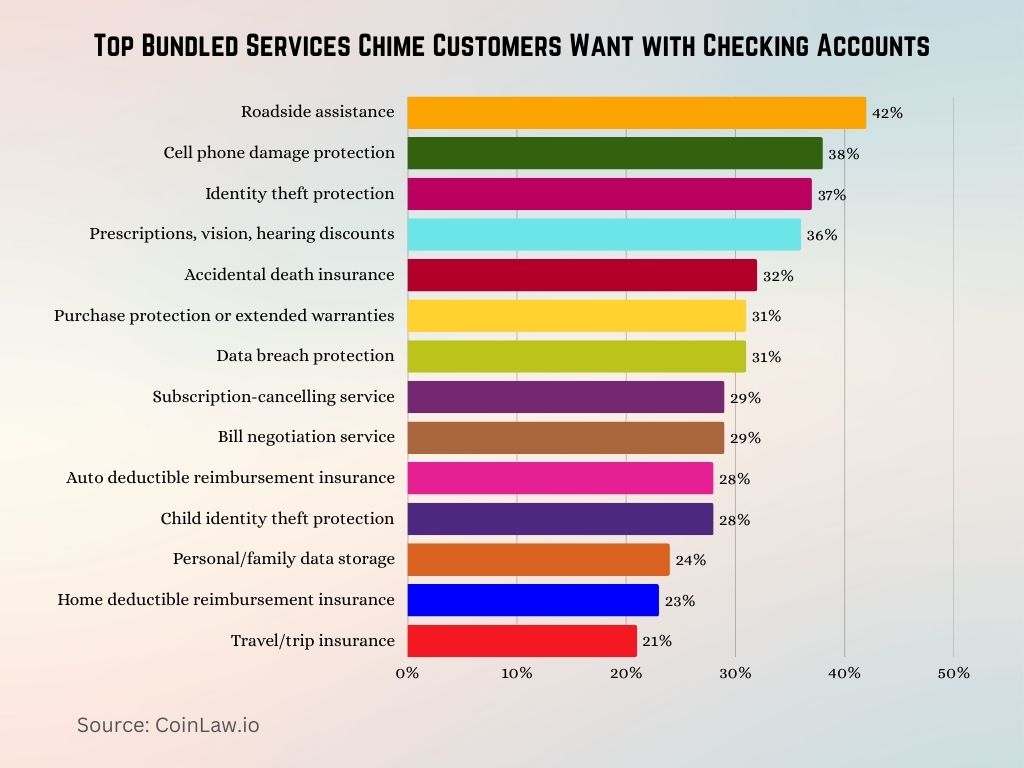

Top Bundled Services Chime Customers Want with Checking Accounts

- 42% of Chime customers are very interested in roadside assistance, making it the most desired bundled service.

- Cell phone damage protection appeals to 38% of customers, highlighting strong demand for mobile-related security.

- Identity theft protection is a priority for 37%, reflecting growing concerns over digital security.

- 36% are keen on prescriptions, vision, and hearing discounts, pointing to an interest in healthcare-related perks.

- Accidental death insurance catches the attention of 32% of respondents, showing demand for critical risk coverage.

- Both purchase protection/extended warranties and data breach protection drew interest from 31% of users.

- Subscription-cancelling services and bill negotiation tools each appealed to 29%, indicating a desire for financial convenience.

- Auto deductible reimbursement and child identity theft protection followed closely, each with 28% interest.

- 24% are interested in personal/family data storage, a sign that digital data security is gaining traction.

- Home deductible reimbursement insurance and travel/trip insurance rounded out the list, with 23% and 21% interest, respectively.

Chime Valuation

- Chime’s valuation climbed to $32 billion in 2025, cementing its status as one of the world’s most valuable fintechs.

- The company’s valuation increased by 28% year-over-year, showing strong investor backing and expanding user adoption.

- In its 2025 Series H round, Chime raised $900 million, fueling aggressive product and global growth strategies.

- Chime’s valuation remains well ahead of Varo Money at $2.8 billion and Current at $2.4 billion in 2025.

- Chime now commands 62% of the US neobanking market, outperforming all major digital-only banking rivals.

- With annual revenue exceeding $1.25 billion, analysts now value Chime north of $32 billion and climbing.

- Chime’s scalable model and improving margins continue to drive high investor confidence and valuation growth in 2025.

Chime vs US Neobanks: Users

- Chime leads US neobanks with 18 million users in 2025, well ahead of Current (4.5 million) and Varo Money (3.8 million).

- Chime now accounts for 62% of neobank users in the US, reinforcing its market dominance.

- Chime’s user base grew by 22% year-over-year, surpassing the neobank industry growth rate of 10% in 2025.

- Chime maintains a stellar 4.8-star rating across both the App Store and Google Play, higher than all major competitors.

- In 2025, 91% of Chime users reported high satisfaction, compared to 73% for Varo Money and 69% for Current.

- Chime’s SpotMe overdraft feature was used by 10 million users in 2025, far ahead of similar services from rivals.

- 57% of all new neobank switchers in 2025 chose Chime, securing its role as the go-to digital bank for first-timers.

Chime’s Primary Customer Base

- 35% of Chime users are gig economy workers, including freelancers and delivery drivers, attracted by early direct deposit and fee-free banking.

- Over 50% of users earn less than $50,000 annually, showcasing Chime’s appeal to middle- and low-income demographics.

- A significant portion of Chime’s user base consists of millennials and Gen Z, with 70% under the age of 35.

- 85% of customers cited fee elimination as the top reason for choosing Chime over traditional banks.

- Chime is popular among unbanked and underbanked individuals, with 45% of new users transitioning from no formal banking account.

- 70% of Chime users are employed full-time, demonstrating the platform’s role in facilitating everyday banking for working professionals.

- Among Chime’s customers, women account for 48%, highlighting its broad demographic appeal.

Product Offerings and Features

- The SpotMe overdraft protection feature allows users to overdraft by up to $200 without fees, benefiting over 8 million users.

- Chime’s “Save When You Spend” feature helped users collectively save over $500 million.

- Early direct deposit enables customers to access paychecks up to two days earlier, a feature used by 60% of account holders.

- Chime offers fee-free ATMs at over 60,000 locations across the US, ensuring accessibility for its users.

- The Chime Credit Builder Card, designed to improve credit scores, saw a 40% increase in adoption, with over 3 million active users.

- Over 90% of transactions on Chime are conducted via its highly rated mobile app, emphasizing the platform’s mobile-first approach.

Market Position and Competitors

- Chime holds a 62% market share in the US neobank segment in 2025, maintaining a strong lead over Current and Varo Money.

- Chime’s app reached over 12.5 million downloads in 2025, far surpassing Varo (2.3 million) and Current (2.7 million).

- Chime’s Net Promoter Score (NPS) hit 77 in 2025, well above the fintech industry average of around 50.

- Chime competes with PayPal and Cash App for gig workers, offering a more banking-focused experience with early pay, fee-free overdrafts, and auto-savings.

- In 2025, Chime expanded integrations with Instacart, DoorDash, Uber, and Lyft to provide perks tailored to the gig economy.

- Analysts expect Chime’s share of the digital banking market to climb to 66% by the end of 2025, reinforcing its dominance.

- Chime captured 53% of new accounts among 25–34-year-olds in 2025, outperforming both neobanks and traditional banks in this key segment.

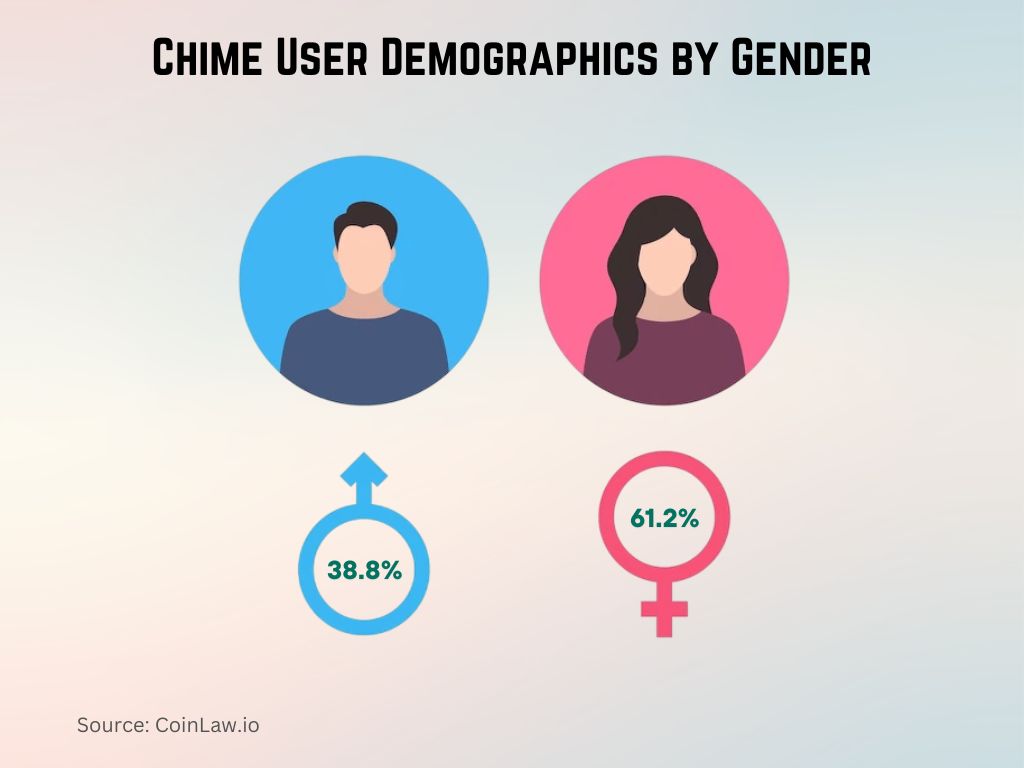

Chime User Demographics by Gender

- 61.2% of Chime users are female, making women the majority of the platform’s customer base.

- 38.8% of users are male, showing a significant gender gap in user adoption.

Recent Developments

- In 2025, Chime expanded its crypto investment feature to support 8 major cryptocurrencies, attracting over 2.5 million users.

- Chime’s enhanced fraud detection system, launched in 2024, has now reduced fraud incidents by 41% year-over-year in 2025.

- The Plaid partnership deepened in 2025, enabling real-time syncing with over 15,000 financial apps and services.

- Chime’s Family Accounts feature gained traction in 2025, with 1.8 million users actively using shared financial tracking tools.

- A major 2025 app redesign improved speed and UX, leading to a 30% increase in monthly app engagement.

- Chime pledged $15 million in 2025 to support financial literacy programs across low-income and underserved communities in the US.

- Chime confirmed its international launch for Q4 2025, starting in Canada and the UK, with pilot testing already underway.

Conclusion

Chime has solidified its position as a trailblazer in the neobank sector, offering innovative, user-centric financial solutions. With an ever-growing user base, robust revenue, and a keen focus on social impact, Chime continues to redefine banking for the modern consumer. Its relentless innovation, coupled with strong market positioning, ensures that Chime will remain a key player in the fintech industry for years to come.