Chainlink has become the backbone of decentralized data delivery, enabling smart contracts to securely interact with real-world information. Chainlink’s role expanded across DeFi, tokenized assets, and institutional systems, making it a central player in Web3 infrastructure. From powering derivatives to bridging cross-chain assets, its oracles now touch nearly every blockchain use case. This article unpacks the latest statistics shaping Chainlink’s growth, adoption, and market strength. Let’s explore what the data reveals.

Editor’s Choice

- Chainlink secured over $93 billion in on-chain value across ecosystems in 2025.

- Chainlink dominates with 67% of the oracle market share, significantly ahead of its competitors.

- As of mid‑2025, Chainlink’s CCIP has expanded to over 60 blockchains, supporting diverse cross-chain use cases and enterprise integrations.

- Data Streams throughput surged by 777% in Q1 2025, expanding decentralized data delivery.

- A whale wallet withdrew $10.2 million in LINK from Binance, signaling institutional accumulation.

- Chainlink staking capacity rose to 45 million LINK, with advanced slashing and alerting features.

- Real estate tokenization projects using Chainlink cut settlement time from weeks to minutes.

Recent Developments

- In Q1 2025, Chainlink processed $20 trillion in Total Value Enabled (TVE).

- The Multistream upgrade enabled a single DON to deliver 1,000s of data points per request.

- Chainlink’s CCIP now spans 50+ blockchains, expanding enterprise interoperability.

- SmartNAV feeds were introduced to support tokenized equity pricing.

- The launch of the Candlestick API enabled access to OHLC trading data for real-time strategies.

- Data Streams expanded from 7 to 24 blockchains, supporting more real-time DeFi applications.

- Chainlink staking v0.2 was launched with a dynamic reward model and slashing capabilities.

- Partnerships expanded with ICE, Ripple, BX Digital, and SWIFT to support real-world asset protocols.

- Chainlink engaged with U.S. regulators, including meetings at the White House.

- Adoption increased across tokenized money markets, compliance tools, and global asset platforms.

Transaction Volume Statistics

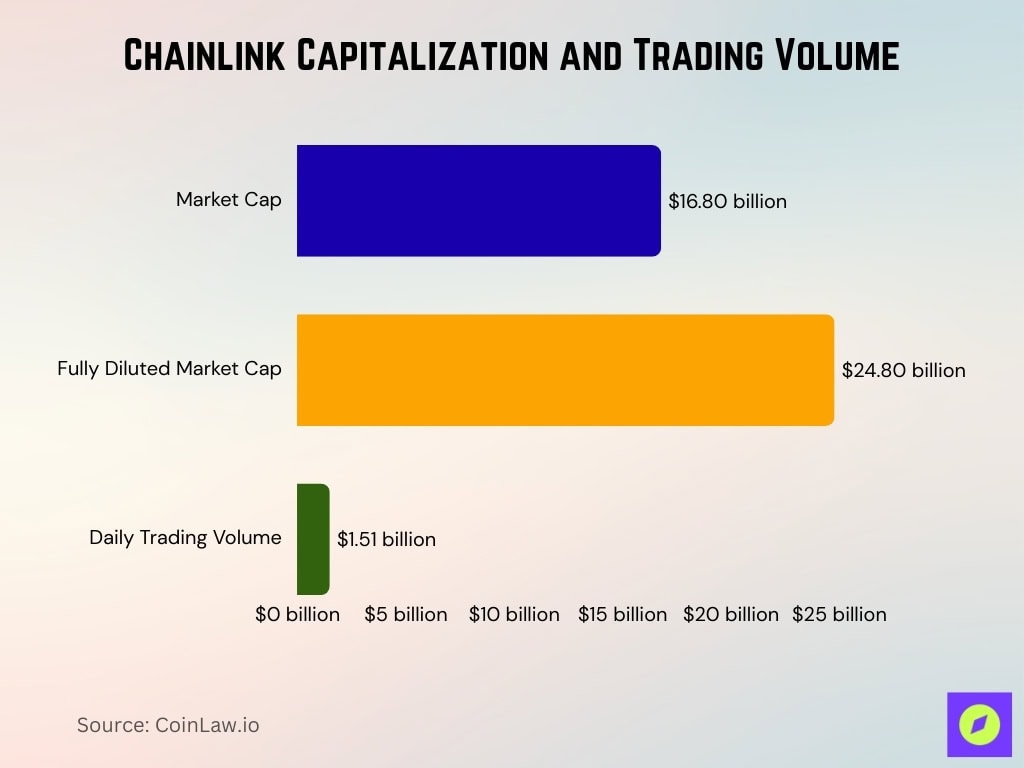

- Market cap is around $16.8 billion, fully diluted cap at $24.8 billion, and daily volume of $1.51 billion.

- On August 15, 2025, LINK saw a 24-hour trading volume spike to 12.84 million, over 5× its 24-hour average of 2.44 million.

- Technical indicators confirmed resistance levels at $25–$26, and institutional interest via high-volume validation.

- Live data shows Chainlink’s 24‑hour trading volume hovers around $2.63 billion, with a market cap of about $16.5 billion.

- LINK ranks #11 in market cap, with a circulating supply of approximately 678 million.

- Volume-to-market cap ratio stands at approximately 0.092, suggesting healthy trading activity.

- LINK maintains consistency above multiple EMAs, signaling sustained buyer momentum.

- On-chain data suggests rising whale accumulation and reduced exchange reserves, contributing to a deflationary dynamic.

Chainlink Price History

- LINK opened 2025 at around $14.80 and surged past $25 in August.

- The price showed consistent growth supported by bullish sentiment and buybacks.

- Resistance zones were observed around $25–$26, triggering institutional interest.

- Price hit a yearly high near $28 before correcting to around $24.

- TradingView listed LINK’s price range from $12.30 to $39.20 as realistic volatility zones.

- Several analysts predicted potential highs for LINK around $32 to $81.70.

- LINK outperformed Bitcoin during several consolidation phases.

- Price movements in 2025 were driven by whale accumulation and reduced exchange reserves.

- LINK showed high correlation with broader crypto recovery trends.

- Token buybacks contributed to a steady floor price formation during Q2 and Q3.

Annual and Quarterly Performance

- LINK rose over 72% year-to-date by Q3 2025.

- Q1 saw 38% growth, supported by TVE expansion and product launches.

- Q2 was marked by a 12% dip, driven by macro conditions and liquidity tightening.

- In Q3, LINK rebounded over 34% due to institutional buy-ins and staking unlocks.

- The CCIP expansion played a key role in quarterly performance metrics.

- On-chain activity for LINK wallets rose by 27% YoY in Q2 2025.

- Staking volume also grew, with 45M LINK locked by mid-year.

- TVS (Total Value Secured) jumped from $50B to $93B within eight months.

- Trading volume remained stable across quarters, averaging $1.9B per day.

- LINK consistently ranked in the top 15 cryptocurrencies by market cap throughout the year.

Chainlink Technical Snapshot

- Current price is $23.59, marking a 6.99% weekly gain.

- Weekly high touched $24.20, while the low dipped to $20.85.

- Opening price for the week was $22.02, with strong momentum through mid-August.

- Key resistance levels stand at $23.59 and $26.46, indicating potential upside pressure.

- Major support zones lie at $21.68, $17.49, $15.48, and $12.75, forming the lower trend line of the channel.

- Volume for the week reached 498.44K, reflecting healthy trading activity.

- Chaikin Money Flow (CMF 20) is +0.20, suggesting positive buying pressure.

- The price continues to trade inside a rising parallel channel, with a bullish breakout target near $36.

Market Capitalization & Trading Volume

- LINK’s market cap hovered around $16.5 billion in August 2025.

- Its fully diluted valuation was estimated at $24.8 billion.

- Average daily trading volume was $2.63 billion.

- LINK ranked #11 among all cryptocurrencies by market cap.

- The volume-to-market cap ratio stood at 0.092, indicating strong liquidity.

- High-volume spikes were recorded during major buybacks and upgrades.

- A single-day volume peaked at 12.84 million LINK traded.

- LINK showed consistent support above key moving averages.

- LINK’s trading pair activity was led by USDT, ETH, and BTC combinations.

- Whale accumulation continued to tighten the circulating supply on exchanges.

Staking Statistics

- Staking v0.2 expanded capacity to 45 million LINK, with approximately 40.9 million LINK reserved for the community and the remainder allocated to node operators.

- Community Stakers can stake up to 15,000 LINK per address; Node Operator Stakers can stake up to 75,000 LINK.

- Variable reward rate allows rewards to adjust based on staking protocol fill level, aligning incentives with usage.

- Node operator reward floor is set at 4.5%, supplemented via delegation from community stakers.

- Unstaking involves a 28-day cooldown and a 7-day claim window, ensuring stability and slashing deterrence.

- Slashing condition applied to ETH/USD feed: node operators risk losing 700 LINK if performance thresholds aren’t met, while alerting earners receive 7,000 LINK.

- As of 2025, staking participation reflects growing trust, though precise staked totals remain dynamic and subject to unbonding.

Chainlink’s USDC Integration and Reserve Transparency

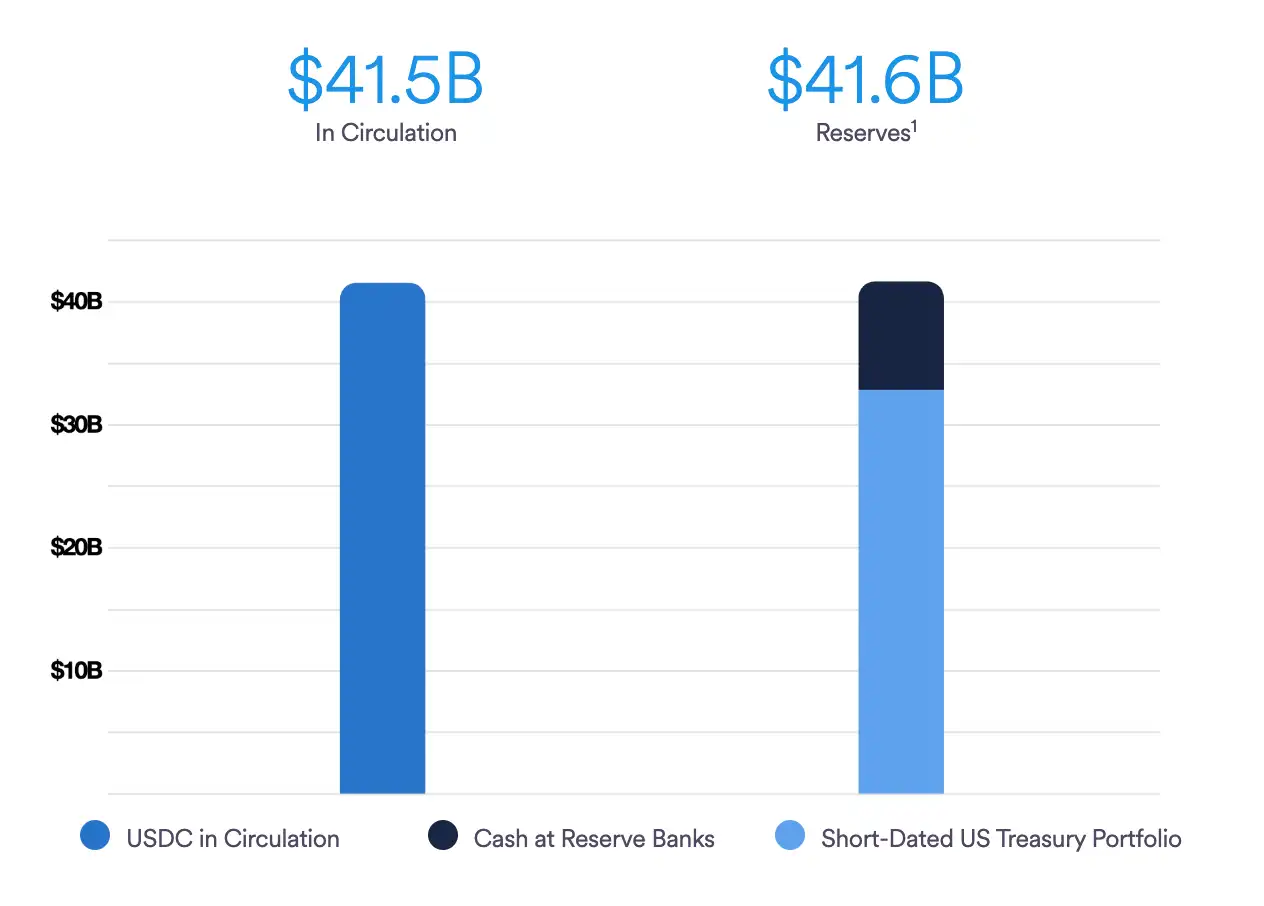

- $41.5 billion USDC is currently in circulation, backed by real-world assets.

- Chainlink oracles help verify that $41.6 billion in reserves securely back the circulating USDC supply.

- Reserves are composed of cash at reserve banks and short-dated U.S. Treasury bonds, enhancing trust and liquidity.

- The $100 million surplus between reserves and circulation reflects overcollateralization, improving stability.

- Chainlink’s infrastructure supports transparent reserve reporting, ensuring reliable on-chain data for DeFi protocols and institutions.

- The dominant reserve allocation is in short-dated Treasuries, showcasing a low-risk, government-backed strategy.

Total Value Secured (TVS) & Oracle Market Share

- As of August 2025, Chainlink secured over $93 billion of on-chain value across ecosystems.

- It controls over 67% of the total oracle market, with 2,000+ Chainlink price feeds in operation.

- On Ethereum, Chainlink secures over 83% of TVS; on Base, it secures nearly 100%.

- Chainlink’s dominance is estimated to be nine times greater than its closest oracle competitor.

- It powers over 90% of DeFi lending and derivatives platforms on Ethereum.

- TVS and Oracle market share continue climbing, reflecting expanding enterprise and DeFi demand.

Partnerships and Ecosystem Growth

- Chainlink’s oracle services are integrated with institutions such as Mastercard, Fidelity International, ANZ, and SWIFT.

- It supports RWA and traditional asset integrations by powering tokenized finance workflows.

- The tokenization of real-world assets, DeFi bridges, and institutional APIs continues fueling ecosystem expansion.

- Cross-chain interoperability via CCIP now spans more than 60 blockchains and processes billions in token transfers.

- Institutional pilots include use cases in asset settlement, compliance, and tokenized security products.

- Broader uptake across DeFi and TradFi underscores a dual-track growth model.

Chainlink (LINK) Price Predictions

- DigitalCoinPrice gave the highest forecast, with a maximum of $55.44 and an average target of $49.91.

- Coinpedia remains bullish, predicting a range from $31 to $47, with an average of $39.

- LongForecast projects a maximum price of $51.08, with a minimum floor of $25.80.

- Cryptopolitan expects a tight range, from $31.65 to $37.83, suggesting price consolidation.

- AMBCrypto sees moderate growth potential, estimating $22.72 minimum and $34.08 maximum, with an average of $28.40.

- Changelly offers the most conservative forecast, with $14.04 minimum and $24.98 maximum.

- InvestingHaven sees potential for a maximum of $44.47, though it lists only a minimum of $17.13.

- 99Bitcoins reports a single average price of $26.29, without high or low bounds.

Major Chainlink Integrations

- Chainlink price feeds are deployed across the major DeFi protocols: Aave, Compound, Synthetix, GMX, Lido, and others.

- Data Streams Expansion (Aug 2025) launched Net Asset Value (NAV) and xStock feeds for tokenized equities.

- The Candlestick API (OHLC data) was added in mid‑August 2025, aiding algorithmic traders and analytics tools.

- CCIP integration supports cross-chain messaging and asset transfers across diverse blockchain networks.

- Enterprise-ready oracles extend Chainlink’s reach into TradFi, tokenized assets, and compliance systems.

- Network updates (e.g., Node v2.26.0) boosted scalability, security, and cross-chain performance.

Blockchain Networks Supported

- Chainlink’s network spans 50+ blockchains, including Ethereum, Solana, Base, Avalanche, Polygon, Arbitrum, and more.

- With CCIP onboarded across chains, token bridges, and interoperable messaging gained resilience and scale.

- Base-specific oracle coverage is near 100% for value and feeds.

- Broad cross-chain coverage cements Chainlink’s role in interoperable finance infrastructure.

- New blockchain support continues via integrations with L2s, EVM-compatible chains, and emerging networks.

DeFi and Smart Contract Usage

- Chainlink underpins more than $93 billion in DeFi value across lending, swaps, derivatives, RWAs, and stablecoins.

- It powers core price feeds used by 90%+ of Ethereum’s DeFi lending/derivatives protocols.

- Developers rely on Chainlink’s feeds for automation, risk monitoring, collateralization logic, and beyond.

- New data tools such as OHLC streams enrich DeFi charts, volatility modeling, and automated strategies.

- Cross-chain capabilities via CCIP enable DeFi protocols to source off-chain data across ecosystems.

- Chainlink’s infrastructure continues to support DeFi composability, growth, and security.

Node and Oracle Data

- Chainlink’s Cross-Chain Interoperability Protocol (CCIP) supports secure messaging and token transfers across over 60 blockchains, processing over $24 billion in token value.

- In early 2025, CCIP-enabled self-serve onboarding via the Cross-Chain Token (CCT) standard, increasing developer access.

- Data Streams throughput surged by 777% in Q1 2025, thanks to the Multistream upgrade.

- Multistream allows a single decentralized oracle network (DON) to deliver 1,000s of unique data points per request.

- Data Streams expanded support from 7 to 24 blockchains, a ~242% increase in Q1.

- OCR3 architecture introduced enhanced programmability for signature schemes, aggregation, scheduling, and data transformations.

- Chainlink processed over $20 trillion in Total Value Enabled (TVE) during Q1 2025, per on-chain metrics.

- Chainlink oracle nodes power functions across governments, DeFi, and enterprise use cases, reinforcing its foundational status.

Community Growth

- On-chain engagement and whale accumulation rose notably in 2025, sustaining Chainlink despite broader crypto corrections.

- Institutional partnerships and developer activity helped deepen ecosystem trust and attract new users.

- Chainlink’s involvement in U.S. regulatory discussions, including meetings at the White House, demonstrated growing policy visibility and community credibility.

- Q1 saw expansive institutional integrations that amplified adoption across geographies.

- DECO Sandbox submissions signaled rising community experimentation with new identity and compliance tools.

- SmartCon and global events featuring Chainlink leadership helped educate developers, investors, and regulators worldwide.

- Chainlink’s metrics transparency via open dashboards supports community engagement and visibility.

Real‑World Use Cases

- SBI Group used CCIP to tokenize Japanese real estate, cutting settlement time from weeks to minutes.

- ADGM and BX Digital adopted Chainlink for tokenized asset registers and pricing.

- Fasanara, with over $4 billion in AUM, deployed Chainlink’s Proof of Reserve and NAV feeds for its tokenized money market fund.

- Ripple integrated Chainlink Price Feeds into its RLUSD stablecoin infrastructure for verified pricing.

- OpenEden used CCIP and Proof of Reserve to secure USDO’s cross-chain liquidity.

- Spiko integrated Chainlink’s NAV data into dashboards for real-time fund tracking.

- DECO Sandbox configurations supported identity verification, sanctions screening, and proof of reserves in real-world workflows.

Comparison with Other Oracle Networks

- Chainlink commands over 67% of the total oracle market share, far exceeding any competitor.

- Analysts estimate Chainlink’s oracle leverage is nine times greater than its nearest rival.

- On Ethereum, Chainlink secures over 83% of TVS, with nearly 100% coverage on Base.

- Dominates DeFi use cases, powering feeds across lending, derivatives, and asset tokenization platforms.

- CCIP provides unique cross-chain messaging and value transfer capability not widely matched by competitors.

- Chainlink’s integration into enterprise systems further differentiates it in institutional oracles.

- The Multistream and OCR3 architecture gives Chainlink unmatched data scalability and programmability.

Institutional Investment Trends

- TVS surged 90% in 2025, pushing secured value past $93 billion.

- A single wallet withdrew $10.2 million worth of LINK from Binance, suggesting institutional accumulation and reduced exchange liquidity.

- Institutional demand rose sharply, supported by partnerships and tokenization use cases.

- Strategic buybacks totaling $4.1 million LINK added buying pressure and scarcity.

- Whale activity and reduced exchange reserves lend Chainlink a deflationary use-case narrative.

- Analysts see LINK as a top-tier accumulation target, outperforming even Bitcoin during consolidation phases.

- Structural upgrades and institutional pilots support growing confidence among long-term, large-scale investors.

Risk and Volatility Metrics

- LINK displays notable technical resistance at $25–$26, with breach signals seen during recent volume surges.

- Forecast models place LINK’s 2025 trading range between $12.30 and $39.20, reflecting wide potential swings.

- Bullish predictions range as high as $81.70, while conservative estimates set ranges near $32.70.

- Price projections suggest potential highs of $32 and long-term targets up to $195 by 2030.

- LINK’s futures and sentiment metrics include an overbought RSI of around 64 and active MACD, signaling momentum but also volatility.

- Trading volume spikes and structural tokenomics suggest LINK price sensitivity to institutional flows and market shifts.

- Market price predictions reflect both high reward and high risk, with price swings between $12 to $40 in 2025 considered possible.

Conclusion

Chainlink’s journey confirms its evolution beyond decentralized finance into institutional-grade infrastructure. With over $93 billion secured, dominant oracle market share, cross-chain innovations, and real-world finance adoption, it’s clear the network is foundational to blockchain integration.

The oracle performance, network scalability, and growing institutional demand underscore Chainlink’s resilience and value creation. Yet, price volatility remains real, $12 to $40 trading ranges reflect macro sentiment, technical levels, and funding flows.

Chainlink remains central to bridging on-chain and off-chain worlds. Whether you’re tracking DeFi reliance, enterprise integrations, or market trends, Chainlink’s stats tell a compelling story. Keep watching, the data-driven narrative is just getting started.