Brazil is holding its first public hearing to consider a bold proposal that would shift up to $19 billion of its national reserves into Bitcoin.

Key Takeaways

- 1Brazil’s Congress is debating Bill 4501/24 to establish a Bitcoin Strategic Reserve worth up to $19 billion.

- 2The reserve would represent 5 percent of Brazil’s $370 billion in foreign reserves, making it the largest Bitcoin holder among nations.

- 3Experts and officials testified in Brasília, with strong support from the Vice President’s camp but skepticism from the Central Bank.

- 4The bill outlines gradual acquisition, biannual reports, and strict oversight to counter concerns over volatility and security.

What Happened?

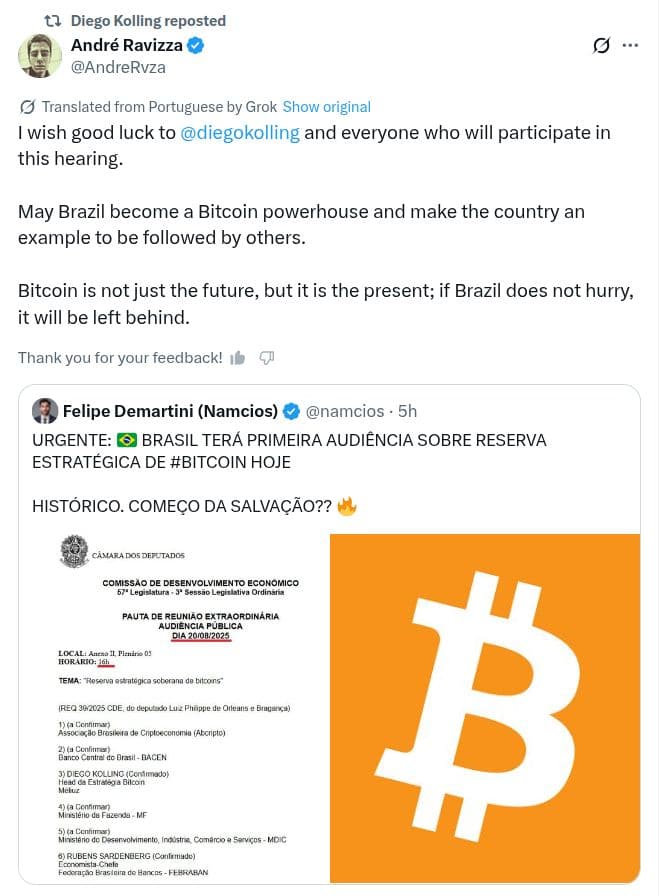

The Economic Development Commission of Brazil’s Chamber of Deputies is holding its first hearing on a bill that could reshape the country’s financial strategy. Bill 4501/24 proposes a Bitcoin Strategic Reserve (RESBit) valued at up to $19 billion, or 5 percent of Brazil’s international reserves. The goal is to modernize treasury management, hedge against exchange rate volatility, and diversify beyond traditional assets like gold and US Treasuries.

Brazil’s Bitcoin Reserve Proposal Unpacked

The proposal was introduced by lawmaker Eros Biondini, who cited international blockchain adoption from countries like El Salvador, Bhutan, China, the United States, and the European Union. The bill suggests Brazil should not just follow but lead in digital financial infrastructure.

The plan would assign custody of the Bitcoin reserve to both the Central Bank and the Finance Ministry, requiring biannual public reports to ensure transparency. Acquisitions would happen gradually, rather than in one large purchase, to limit exposure to Bitcoin’s notorious price swings.

Key technical features of the reserve include:

- Cold storage for secure offline custody.

- AI-based monitoring tools for enhanced security.

- Criminal penalties for mismanagement to reinforce accountability.

These measures are considered unusually detailed for crypto legislation and are meant to build credibility in both domestic and international markets.

Divided Opinions from Experts and Institutions

The session in Brasília included input from high-profile speakers such as Diego Kolling, head of Bitcoin strategy at Méliuz, and Julia Rosim, public policy lead at Bitso and coordinator at ABcripto. They emphasized the role of Bitcoin as a strategic hedge and a way to integrate the private sector’s crypto enthusiasm into national policy.

Deputy Luiz Philippe de Orleans e Bragança, who requested the hearing, stressed the need for “technical contributions from monetary authorities” before the bill proceeds. He believes central bank input is critical to refining the legislation.

Meanwhile, Vice President Geraldo Alckmin’s office has expressed clear support, with staff publicly referring to Bitcoin as “digital gold.” They see it as a step toward economic sovereignty and innovation. However, the Central Bank of Brazil remains opposed, calling Bitcoin too volatile and risky for sovereign reserves.

What Comes Next in the Legislative Process?

The Economic Development Commission’s hearing is just the first step. The bill must pass through four additional congressional committees:

- Science, Technology and Innovation

- Finance and Taxation

- Constitution, Justice and Citizenship

- Economic Development

After that, it must be approved by the full Chamber of Deputies, and then by the Brazilian Senate to become law.

If enacted, the RESBit would instantly place Brazil ahead of all other nations in Bitcoin holdings by dollar value. It could acquire more than 150,000 BTC at current prices, surpassing the United States’ seized holdings and El Salvador’s national reserve.

Why Brazil’s Move Matters Globally?

Brazil is not a newcomer to crypto. According to Chainalysis, it leads Latin America in adoption and ranks 10th globally, with $76 billion in crypto transactions in 2024. About 12 percent of Brazilians already own crypto.

By creating a Bitcoin reserve, Brazil would be institutionalizing an asset that many of its citizens already trust, bridging private enthusiasm with public policy. This shift could influence other Latin American economies also grappling with inflation and dependence on the US dollar.

CoinLaw’s Takeaway

Honestly, this could be a game-changer. I’ve seen countries talk big about Bitcoin, but few back it up with real action like this. In my experience covering financial legislation, the level of detail and planning in this proposal is rare for crypto. If Brazil moves forward, it could be the first G20 nation to put its money where its mouth is and use Bitcoin as a serious hedge. I find that incredibly bold and possibly precedent-setting. Sure, volatility is a risk, but the infrastructure laid out here shows they’re not taking it lightly. This isn’t just about buying Bitcoin, it’s about reshaping global finance strategy.