BitMine has added another 21,537 ETH to its massive crypto holdings, staying committed to its Ethereum strategy despite billions in paper losses and a steep stock decline.

Key Takeaways

- BitMine purchased 21,537 ETH valued at $60 million, raising its total holdings to over 3.5 million ETH, about 3% of Ethereum’s circulating supply.

- The company blames recent ETH price drops on market liquidity shocks, not on Ethereum’s fundamentals.

- BitMine announced a new staking infrastructure project called MAVAN, aiming to go live in 2026.

- It also declared a $0.01 annual dividend, signaling confidence in its long-term crypto strategy.

What Happened?

BitMine has once again expanded its Ethereum portfolio, purchasing over 21,500 ETH even as its stock price slumps and its crypto holdings remain deep in the red. The company is doubling down on its belief in Ethereum’s long-term value, launching a new validator network and issuing a dividend to reassure shareholders.

Tom Lee(@fundstrat)’s #Bitmine is still buying $ETH.

— Lookonchain (@lookonchain) November 23, 2025

A new wallet 0x5664 — likely linked to #Bitmine — just received 21,537 $ETH($59.17M) from the #FalconX 8 hours ago.https://t.co/8kg77vYddh pic.twitter.com/FKivNNe0jM

BitMine Strengthens ETH Holdings Despite Market Woes

On November 23, blockchain analytics platform Lookonchain reported that a wallet tied to BitMine received 21,537 ETH from FalconX, an institutional crypto prime broker. The transaction, worth about $60 million, increases BitMine’s total Ethereum stash to over 3.5 million ETH.

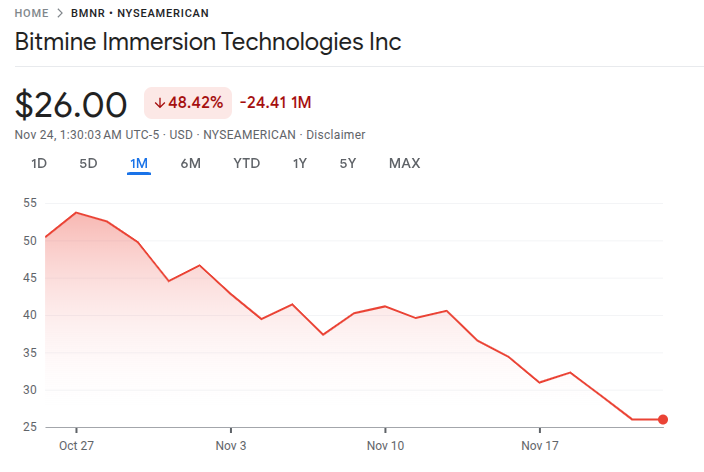

This move comes amid a rough month for Ethereum, which has seen prices tumble to around $2,808, down 29% over the past 30 days. The downturn has hit BitMine hard, with its ETH reserve now facing an estimated $4 billion in unrealized losses. The company’s stock has fallen nearly 47% in the same time period.

Despite this, BitMine remains committed to its “Strategic ETH Reserve” strategy. The company sees the recent decline as a temporary liquidity-driven event, not a fundamental flaw in Ethereum.

Blaming the Liquidity Shock, Not Ethereum

BitMine representative Thomas Lee attributed the recent market downturn to what he described as an October 10 “liquidity shock” that wiped out nearly $20 billion in leveraged crypto positions. He compared the event to the post-FTX collapse in 2022, noting that similar shocks have historically cleared in about 8 weeks, followed by strong price recoveries.

Lee said:

Introducing the MAVAN Validator Network

BitMine is now shifting from being just a passive Ethereum holder to an active player in the blockchain’s proof-of-stake ecosystem. On November 21, the company announced its plan to launch a U.S.-based staking platform, the Made in America Validator Network (MAVAN), in early 2026.

The company said it has already selected three pilot partners to test validator operations. Lee stated:

If BitMine decides to stake its full ETH reserve, it could begin earning annual staking rewards, turning its dormant assets into a reliable source of cash flow.

Dividend Declaration Shows Strategic Confidence

In a first among major crypto treasury firms, BitMine also announced a $0.01 per share annual dividend. While small, the move signals that the company is confident in its long-term vision and aims to return value to investors even during market slumps.

By combining Ethereum accumulation, a planned validator network, and shareholder dividends, BitMine is clearly signaling its intention to pivot from a holding-only model to an active Ethereum ecosystem participant.

CoinLaw’s Takeaway

I’ve seen many companies panic when markets crash, but BitMine is doing the opposite. Instead of cutting losses, they’re buying more, building infrastructure, and even paying a dividend. That’s a bold strategy, and it tells me they are thinking long term. In my experience, companies that double down during downturns often come out stronger on the other side. If their validator network works and ETH recovers as they expect, BitMine might just prove all the doubters wrong.