Back in 2009, when Bitcoin quietly emerged from the mind of a pseudonymous developer, it was a digital curiosity, a challenge to traditional money. Fast forward to today, and it stands as a global financial force. Meanwhile, Tether was born out of necessity: a response to crypto’s infamous volatility. One promises decentralization and limited supply; the other offers price stability and pegged value. As we enter 2025, the debate around Bitcoin and Tether is no longer philosophical; it’s statistical, practical, and rooted in real-world adoption. This article breaks down the numbers driving both giants in the crypto space, helping you understand not just where they stand, but where they might be headed.

Key Takeaways

- 1Bitcoin’s market cap stands at $1.17 trillion as of Q2 2025, while Tether follows with a stable yet impressive $111 billion.

- 2Tether’s 24-hour trading volume regularly exceeds $90 billion, outpacing Bitcoin’s daily volume of $38 billion.

- 3In 2025, Bitcoin’s price volatility averaged 2.8%, compared to Tether’s consistent deviation of under 0.1%.

- 4Tether’s share in stablecoin transactions accounts for 71% of all stablecoin value transferred in 2025.

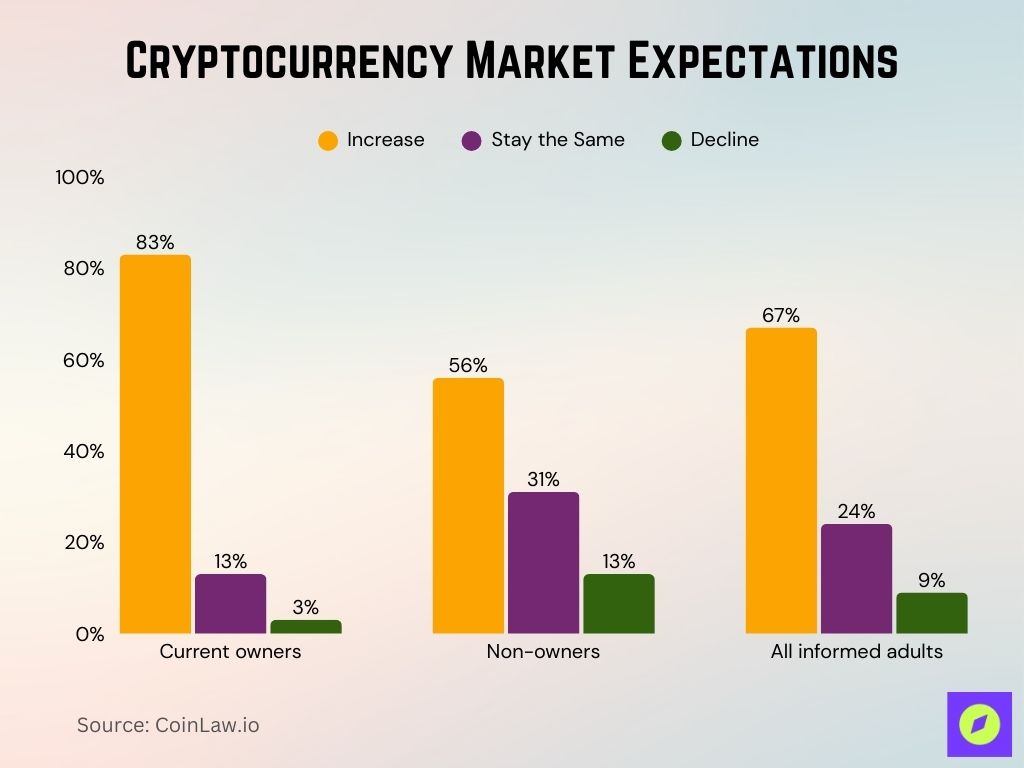

Cryptocurrency Market Expectations

- 83% of current crypto owners believe the cryptocurrency market will increase in 2025, showing strong optimism among active investors.

- Only 13% of current owners think the market will stay the same, and a mere 3% expect a decline.

- Among non-owners, 56% expect the market to increase, while 31% believe it will stay the same, and 13% foresee a decline.

- For all informed adults, 67% anticipate an increase in the market, 24% expect no change, and 9% predict a decline.

Market Capitalization Comparison

- As of mid-2025, Bitcoin’s market capitalization is $1.17 trillion, solidifying its dominance among all cryptocurrencies.

- Tether’s market cap remains stable at around $111 billion, making it the third-largest cryptocurrency overall.

- In the past year, Bitcoin’s market value has increased by 27%, largely due to ETF inflows and institutional demand.

- Tether’s market cap has grown by 7% since late 2024, reflecting increased usage in DeFi and cross-border payments.

- Bitcoin comprises approximately 47.5% of the total crypto market cap in 2025.

- Tether maintains about 4.5% of the total crypto market cap, yet it processes more transactions by volume than Bitcoin.

- The total combined market cap of Bitcoin and Tether accounts for over 52% of the top 10 crypto assets.

- Tether’s market cap stability has deviated less than 0.01% over the past 12 months.

- In 2025, Bitcoin hit an all-time high valuation of $73,000, driving a surge in total market capitalization.

- Tether’s issuance rate peaked in Q1 2025 at over $3.4 billion/month, primarily on Tron and Ethereum networks.

Trading Volume

- Tether’s average daily trading volume in 2025 is $90 billion, consistently the highest of any crypto asset.

- Bitcoin’s daily trading volume stands around $38 billion, often surging during high-volatility periods.

- On Binance alone, Tether (USDT) accounts for 41% of all transactions by pairings.

- Tether is used in more than 73% of global crypto spot trades in 2025.

- In the first half of 2025, Bitcoin’s 30-day average trading volume is up 19% year-over-year.

- Tether’s dominance in perpetual futures contracts has grown to 62% of all stablecoin-based margin trading.

- The top three exchanges (Binance, OKX, and Bybit) reported over $240 billion/month in USDT volume each.

- Bitcoin saw its highest single-day trading volume of $82 billion in March 2025, following a rate policy announcement.

- Tether’s trading pairs are available on over 400 exchanges, more than any other crypto asset.

- Tether-ETH and Tether-BTC remain the most traded crypto pairs worldwide in 2025.

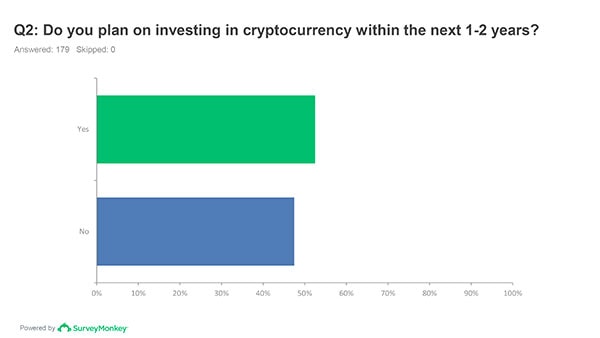

Future Plans to Invest in Cryptocurrency (Next 1–2 Years)

- 179 respondents answered the question; 0 skipped.

- About 50% said Yes, they plan to invest in cryptocurrency within the next 1–2 years.

- Roughly 50% responded No, indicating no current investment intentions.

Price Volatility Trends

- Bitcoin’s average daily volatility in 2025 is 2.8%, significantly reduced from its five-year average of 4.1%.

- Tether’s price deviation from $1 remained under 0.1% throughout the first half of the year.

- In January 2025, Bitcoin experienced a sharp 9.3% intraday drop, its largest of the year so far.

- Tether briefly depegged to $0.998 in April 2025 during a liquidity crunch on a minor exchange.

- Bitcoin’s realized volatility over 30 days is currently 27.4%, a multi-year low.

- Tether’s standard deviation across all supported blockchains remained below 0.02 in the past 90 days.

- Bitcoin volatility has been more correlated with US monetary policy news than tech-sector equity movements in 2025.

- Tether’s stability index on DeFi platforms is consistently above 99.95, indicating minimal slippage during trades.

- The volatility ratio (BTC/USDT) reached 33:1 in June 2025, underscoring Tether’s utility as a hedge asset.

- Bitcoin’s implied volatility in options markets sits at 41%, reflecting moderate market uncertainty around ETF flows.

Adoption Rates and Use Cases

- Bitcoin adoption among Fortune 500 companies has reached 9.4%.

- Tether is used by 78% of decentralized exchanges (DEXs) as their default stablecoin for liquidity pools.

- In 2025, over 420 million people globally own or use Bitcoin, either directly or through ETFs and payment apps.

- Tether payments are accepted by 42% of cross-border e-commerce merchants serving Latin America and Southeast Asia.

- Bitcoin ATMs now exceed 39,000 units globally, with 88% of them located in North America and Europe.

- Tether is the leading on-ramp for crypto in high-inflation economies like Argentina, Turkey, and Nigeria.

- Bitcoin Lightning Network usage grew by 68% YoY, processing over $6 billion in microtransactions by Q2 2025.

- Tether accounts for 84% of stablecoin usage in Web3 gaming platforms, particularly for in-game economies.

- Over 120 countries allow or regulate Bitcoin transactions, with 15 issuing formal tax guidelines on capital gains.

- Tether is integrated into 50+ wallets and apps, including MetaMask, Trust Wallet, and Binance Pay.

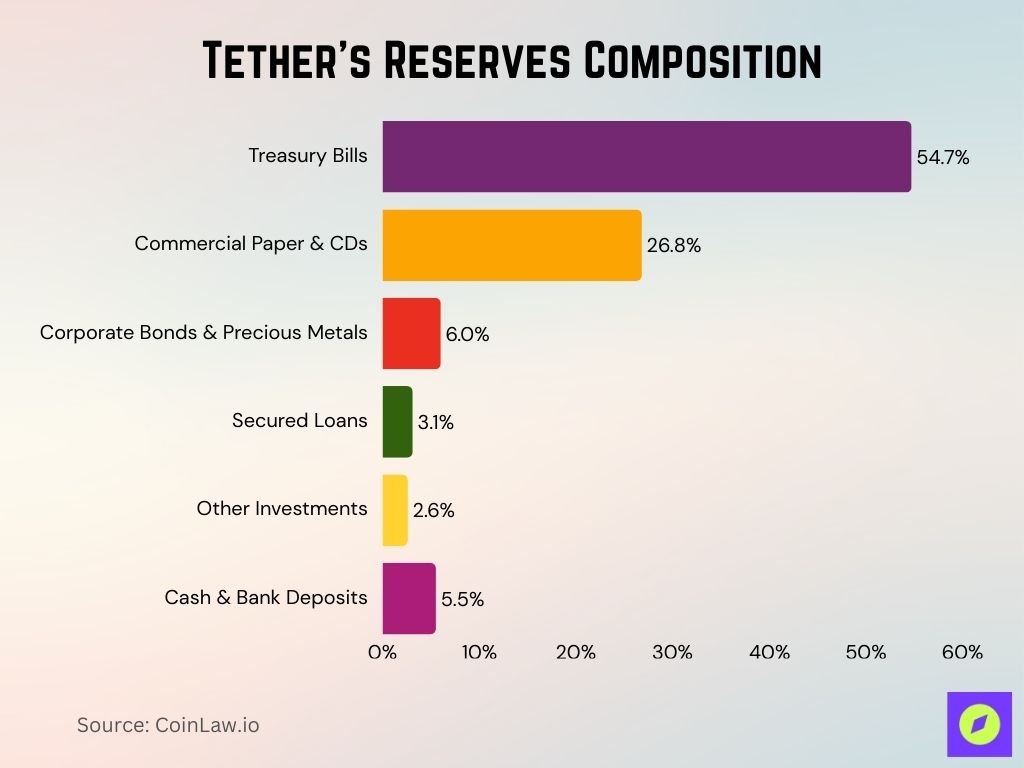

Tether’s Reserves Composition

- The largest portion of Tether’s reserves is in Treasury Bills, making up 54.7% of total assets.

- Commercial Paper & Certificates of Deposit (CDs) account for 26.8%, showing a strong reliance on short-term debt instruments.

- Corporate Bonds & Precious Metals make up 6.0%, reflecting a smaller allocation to diversified financial and tangible assets.

- Secured Loans represent 3.1% of reserves, indicating some exposure to loan-backed instruments.

- Other Investments contribute 2.6%, comprising minor alternative holdings.

- Cash & Bank Deposits hold a 5.5% share, offering liquidity for redemptions and operational needs.

Blockchain Activity and Transaction Counts

- Bitcoin’s average daily transaction count in 2025 is 410,000, boosted by Ordinals and L2 activity.

- Tether records over 5.3 million transactions per day, across all chains including Tron, Ethereum, Solana, and Avalanche.

- Bitcoin transaction fees average $2.17 per transaction in 2025, compared to $0.0009 for Tether on Tron.

- Bitcoin blocks are now averaging 1.8 MB, driven by inscriptions and non-monetary usage.

- Tether on Tron is responsible for 68% of its total transaction count in 2025.

- Bitcoin mempool congestion peaked during ETF-fueled hype in March, with over 320,000 pending transactions.

- Tether processed more than 1.8 billion total transactions in the first half of 2025 alone.

- Bitcoin average block time remains steady at 9.7 minutes, while Tether enjoys instant finality on L2 chains.

- Bitcoin Taproot adoption has increased to 42% of transactions, primarily for enhanced privacy and smart contract usage.

- Tether smart contract invocations on Ethereum have decreased by 21%, while Tron usage surged by 33%.

Wallet Distribution and Ownership Concentration

- Bitcoin’s total wallet count surpassed 1.3 billion in 2025, including custodial, non-custodial, and hardware-based wallets.

- Tether is held by over 74 million unique wallet addresses, with a noticeable surge on Tron-based accounts.

- Bitcoin whales (addresses holding over 1,000 BTC) control 10.7% of the total supply, the lowest since 2017.

- The top 100 Tether addresses hold 26.4% of the total supply, indicating centralized reserves tied to exchanges and platforms.

- Bitcoin’s Gini coefficient of wealth distribution improved to 0.85, suggesting modest decentralization over time.

- Tether’s ownership concentration is more utility-driven, with over 80% of large wallets belonging to trading platforms or liquidity providers.

- In 2025, non-custodial Bitcoin wallets grew by 22%, driven by privacy concerns and hardware wallet campaigns.

- Tether is the dominant stablecoin in 40 of the top 50 DeFi protocols by TVL, based on wallet liquidity positions.

- Bitcoin’s smallest denomination (satoshi) is now commonly used in micropayments across 200+ global services.

- Tether micro-wallets under $50 account for 33% of total wallet volume, especially in emerging markets.

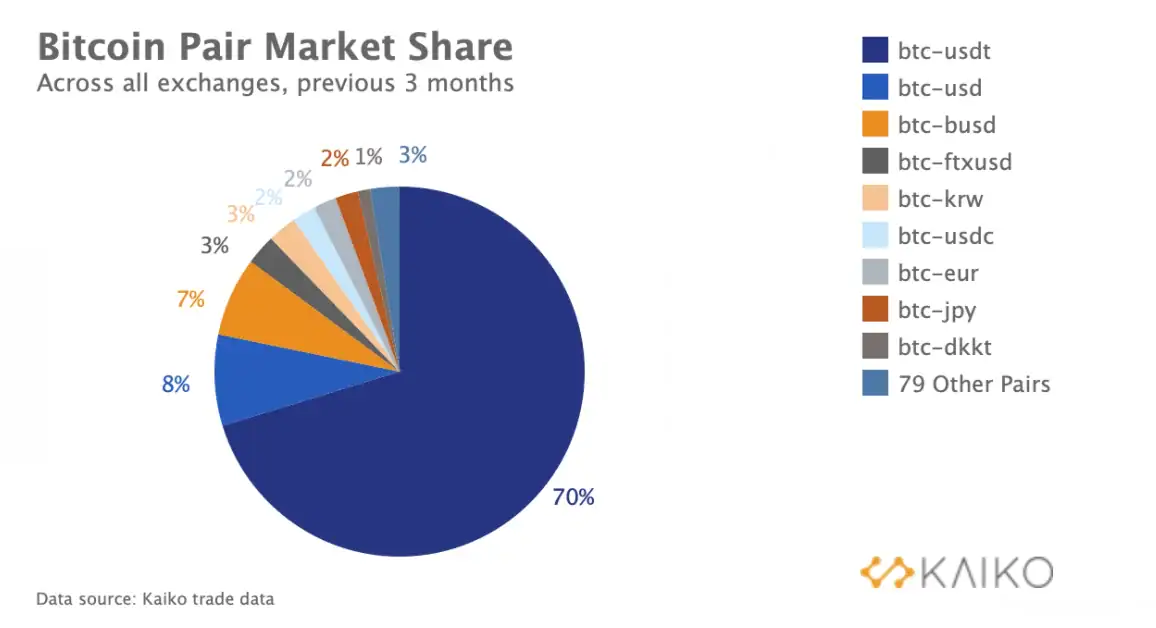

Bitcoin Trading Pair Market Share

- btc-usdt dominates with a massive 70% market share across all exchanges.

- btc-usd follows with 8%, and btc-busd holds 7% of the market.

- Smaller but notable shares include btc-ftxusd and btc-krw at 3% each.

- Other pairs like btc-usdc and btc-eur account for 2% each.

- btc-jpy and btc-dkkt trail behind at 1% and 2% respectively.

- A combined group of 79 other trading pairs makes up the remaining 3% of the market.

Exchange Listings and Liquidity Metrics

- Bitcoin is listed on 100% of centralized crypto exchanges globally.

- Tether is supported on over 450 exchanges, the highest of any cryptocurrency in 2025.

- Bitcoin’s average liquidity score across major exchanges is 827/1000, according to CoinGecko’s liquidity index.

- Tether liquidity pools on DEXs hold over $19.5 billion in combined liquidity, surpassing USDC and DAI.

- Tether pairs make up 71% of all stablecoin trading volume on Uniswap, PancakeSwap, and Curve.

- Bitcoin trading spread remains tight, averaging just 0.12% across Tier 1 exchanges.

- Tether has the lowest slippage rate (under 0.01%) in large-volume trades compared to other stablecoins.

- In 2025, Tether’s daily withdrawal volume on Binance alone exceeds $1.8 billion.

- Bitcoin spot ETF liquidity has reached $6.3 billion/day, especially after US market expansion in early 2025.

- Tether is used in 62% of institutional OTC desk settlements, primarily in Asia and Europe.

Regulatory Status and Legal Considerations

- Bitcoin is legal in 122 countries, with 37 having clear taxation and usage policies.

- Tether is formally recognized or allowed in 89 jurisdictions, though with varied disclosure requirements.

- In 2025, the SEC reclassified Bitcoin as a non-security, reaffirming its commodity status.

- Tether Limited has begun quarterly attestations and stress testing reports, responding to regulatory pressure from the EU and the US.

- Bitcoin ETFs are now approved in 9 countries, including the US, Canada, and Japan.

- Tether faces scrutiny in five major economies, including India and Brazil, over reserve transparency.

- Bitcoin mining licenses are now mandatory in six US states, part of evolving environmental oversight policies.

- Tether became the first stablecoin to launch under the new MiCA regulations in the EU.

- The IRS now treats Bitcoin staking rewards as taxable income upon receipt, even when compounded.

- Tether’s reserve composition in 2025 is 82% in short-term US Treasuries, with the remainder in cash and commercial paper.

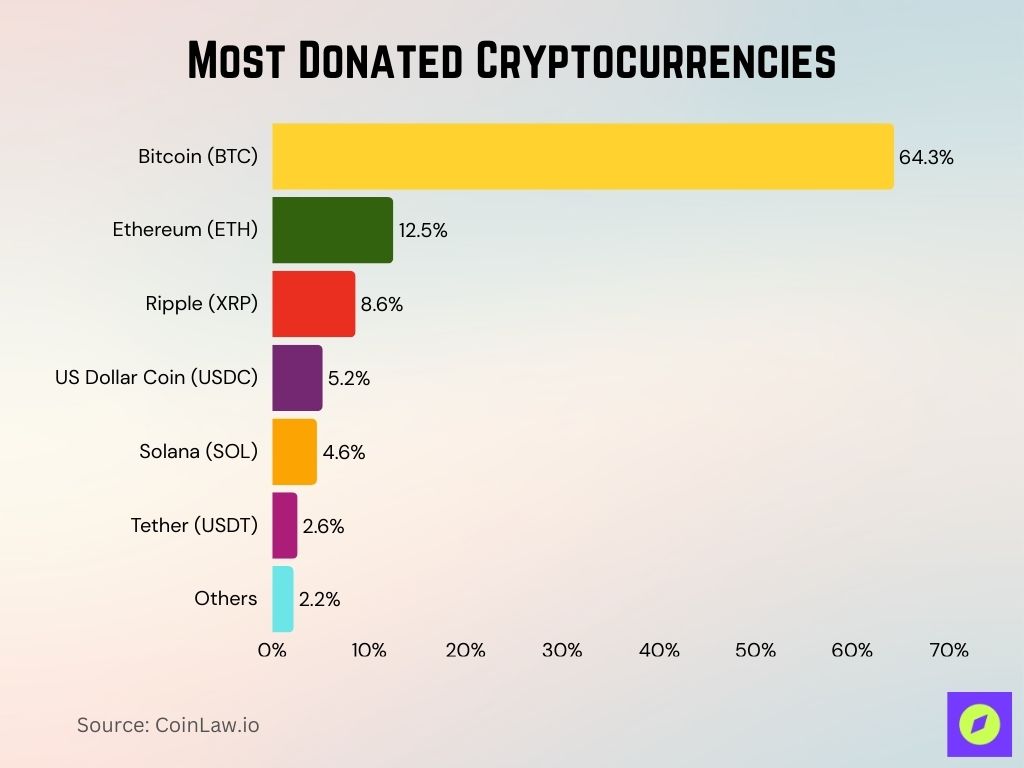

Most Donated Cryptocurrencies

- Bitcoin (BTC) leads by a wide margin, making up 64.3% of all crypto donations.

- Ethereum (ETH) ranks second, contributing 12.5% of total donations.

- Ripple (XRP) accounts for 8.6%, showing notable donor adoption.

- US Dollar Coin (USDC) makes up 5.2%, reflecting stablecoin support in donations.

- Solana (SOL) represents 4.6%, a growing presence among newer crypto assets.

- Tether (USDT) holds a 2.6% share, often used for its stable value.

- Other cryptocurrencies combined make up the remaining 2.2% of donations.

Stablecoin vs. Cryptocurrency Performance Metrics

- In 2025, Bitcoin’s ROI year-to-date is +31.2%, outperforming most major tech stocks.

- Tether maintains a flat 0% ROI, consistent with its pegged value model and reserve-backed structure.

- Bitcoin’s Sharpe ratio (risk-adjusted return) improved to 1.42, while Tether’s remains near zero due to negligible volatility.

- Bitcoin’s correlation to the S&P 500 dropped to 0.18, enhancing its appeal as a diversification asset.

- Tether-based DeFi yield products offer average returns of 4.7% APY across lending protocols.

- Bitcoin’s annualized volatility stands at 41.3%, while Tether’s is below 1%, indicating its stability utility.

- Bitcoin outperformed gold by 19% in the first half of 2025, especially during market uncertainty.

- Tether’s usage in FX arbitrage rose by 28%, as traders capitalize on exchange price differences across borders.

- Bitcoin’s adjusted NVT ratio is 74.6, reflecting strong network valuation per transaction volume.

- Tether is responsible for 79% of stablecoin-enabled remittance flows in 2025, especially in regions with currency restrictions.

Institutional vs. Retail Usage

- Institutional wallets now hold 6.5% of the total Bitcoin supply, a record high in Q2 2025.

- Tether’s institutional transfers exceed $18 billion/day, particularly among OTC desks and global settlements.

- Retail users account for 53% of active Bitcoin wallets, driven by mobile app integrations and education efforts.

- Tether transactions under $100 account for 35% of volume, indicating high accessibility among small-scale users.

- Bitcoin ETFs have attracted over $52 billion in institutional inflows since their global rollout in early 2025.

- Tether is used in 92% of retail-driven swaps on mobile-first wallets like Trust Wallet and SafePal.

- Bitcoin custodial solutions for institutions grew by 44% YoY, led by services like Coinbase Prime and BitGo.

- Tether adoption by fintechs expanded across 26 new markets, often serving as rails for mobile money platforms.

- Bitcoin futures markets account for over $28 billion in open interest, 74% of which is institutional.

- Tether-powered payroll systems are now used by over 5,000 small businesses worldwide, particularly in Latin America and Southeast Asia.

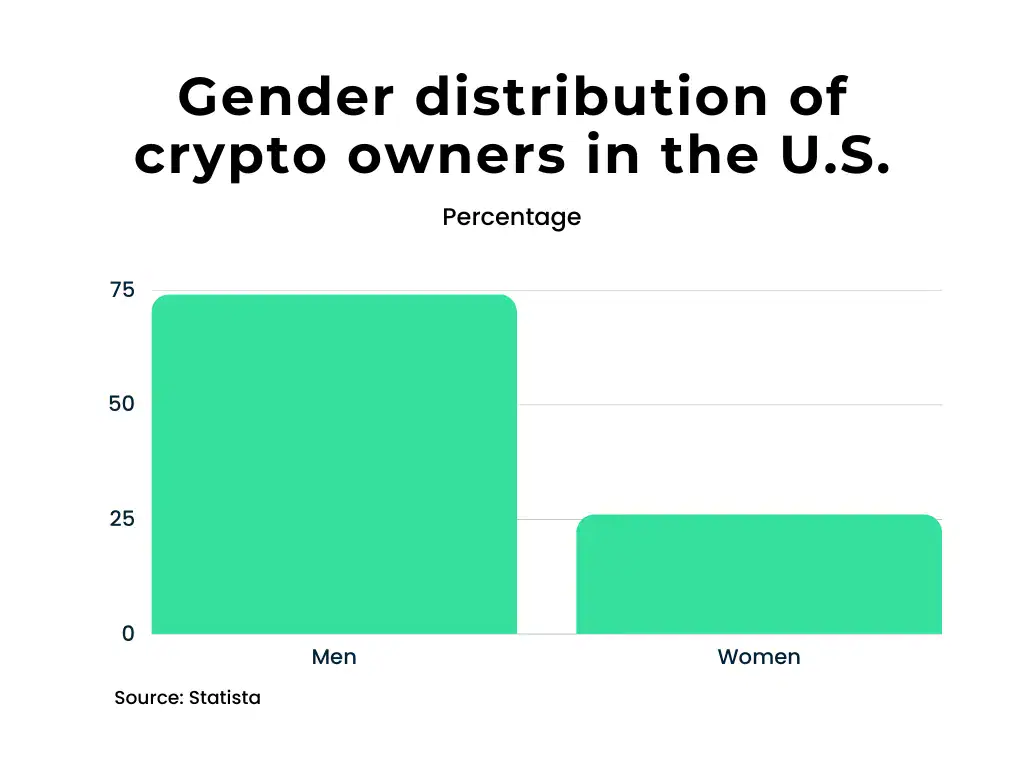

Gender Distribution of Crypto Owners in the U.S.

- Men make up the overwhelming majority of crypto owners in the U.S., accounting for roughly 75% of ownership.

- Women represent only about 25%, highlighting a significant gender gap in cryptocurrency participation.

Environmental Impact and Energy Consumption

- Bitcoin network energy consumption reached 123 TWh/year in 2025.

- Carbon intensity per BTC mined dropped to 349 gCO₂/kWh, reflecting improved mining efficiency.

- Over 59% of Bitcoin mining is powered by renewables or low-carbon energy sources as of May 2025.

- Tether’s environmental footprint is negligible, with less than 0.001% of crypto’s total energy usage.

- Bitcoin miners in the US contributed $1.9 billion in local economic activity through energy partnerships and tax revenue.

- Tether issued a sustainability report for the first time, outlining efforts to offset emissions from cloud operations and hosting.

- Bitcoin’s move to energy audits by third parties has now been adopted by 18% of large mining firms.

- Tether’s carbon disclosures are now part of quarterly attestations, aligned with EU MiCA mandates.

- Bitcoin mining heat reuse programs expanded in colder regions like Canada and Iceland, impacting 7% of industrial operations.

- Tether’s digital issuance process is built on highly efficient smart contracts, with average energy consumption per transaction estimated at under 0.001 kWh.

Security Incidents and Risk Factors

- Bitcoin network uptime remains at 99.989% since inception, with zero critical consensus failures in 2025.

- Tether smart contracts experienced zero exploits in 2025, according to CertiK and Chainalysis reports.

- Bitcoin wallets saw an uptick in phishing-related thefts, totaling $235 million lost across platforms in H1 2025.

- Tether impersonation scams rose by 14%, often targeting users on Telegram and unverified exchanges.

- Bitcoin protocol-level bugs were not reported in 2025, affirming robust open-source governance.

- Tether reserve audits are now monitored by two independent accounting firms, reducing reputational risks.

- Bitcoin custodians reported 5 minor breaches, all resolved without user fund loss due to insurance policies.

- Tether contract addresses are now whitelisted with dynamic blacklisting features to freeze illicit funds.

- Bitcoin mixer usage dropped by 31% due to stricter KYC enforcement across exchanges.

- Tether blacklisted over 370 addresses linked to OFAC-sanctioned entities, aiding regulatory compliance efforts.

Recent Developments in Bitcoin and Tether

- Bitcoin ETFs launched in Japan and the UK in early 2025, adding $7.4 billion in cumulative inflows.

- Tether announced full MiCA compliance, making it the first stablecoin approved under Europe’s crypto framework.

- Bitcoin surpassed $73,000 in March 2025, setting a new all-time high amid global ETF launches.

- Tether introduced a multi-chain issuance dashboard, helping users verify tokens across all supported blockchains.

- Bitcoin Layer 2 networks like Stacks and Rootstock saw 160% growth in user adoption year-over-year.

- Tether launched Tether Gold+, a gold-pegged variant backed by LBMA-certified reserves.

- The Bitcoin halving event in April 2024 led to renewed attention in Q1 2025, as block rewards were reduced to 3.125 BTC.

- Tether partnered with Shopify, allowing USDT payments across 1 million+ stores worldwide.

- Bitcoin developers proposed BIP-330, enhancing smart contract functionality on native Bitcoin.

- Tether’s transparency site now updates reserve holdings in real time, offering unmatched visibility in stablecoin issuance.

Conclusion

Bitcoin and Tether serve different roles in the digital asset ecosystem, but their influence is equally undeniable. In 2025, Bitcoin continues to thrive as a decentralized store of value and speculative asset, bolstered by institutional inflows and evolving regulation. Tether, meanwhile, strengthens its grip on liquidity, remittances, and real-world crypto utility, especially in emerging markets. The statistics paint a clear narrative: Bitcoin brings upside potential and decentralization; Tether delivers reliability and scale. Understanding their statistical contrasts is not just helpful, it’s essential for anyone navigating the maturing world of crypto finance.