Bitcoin sank to fresh multi-month lows Thursday, dragged down by rising geopolitical tensions and a mass exodus from crypto ETFs that saw investors pull out over $530 million in a single day.

Key Takeaways

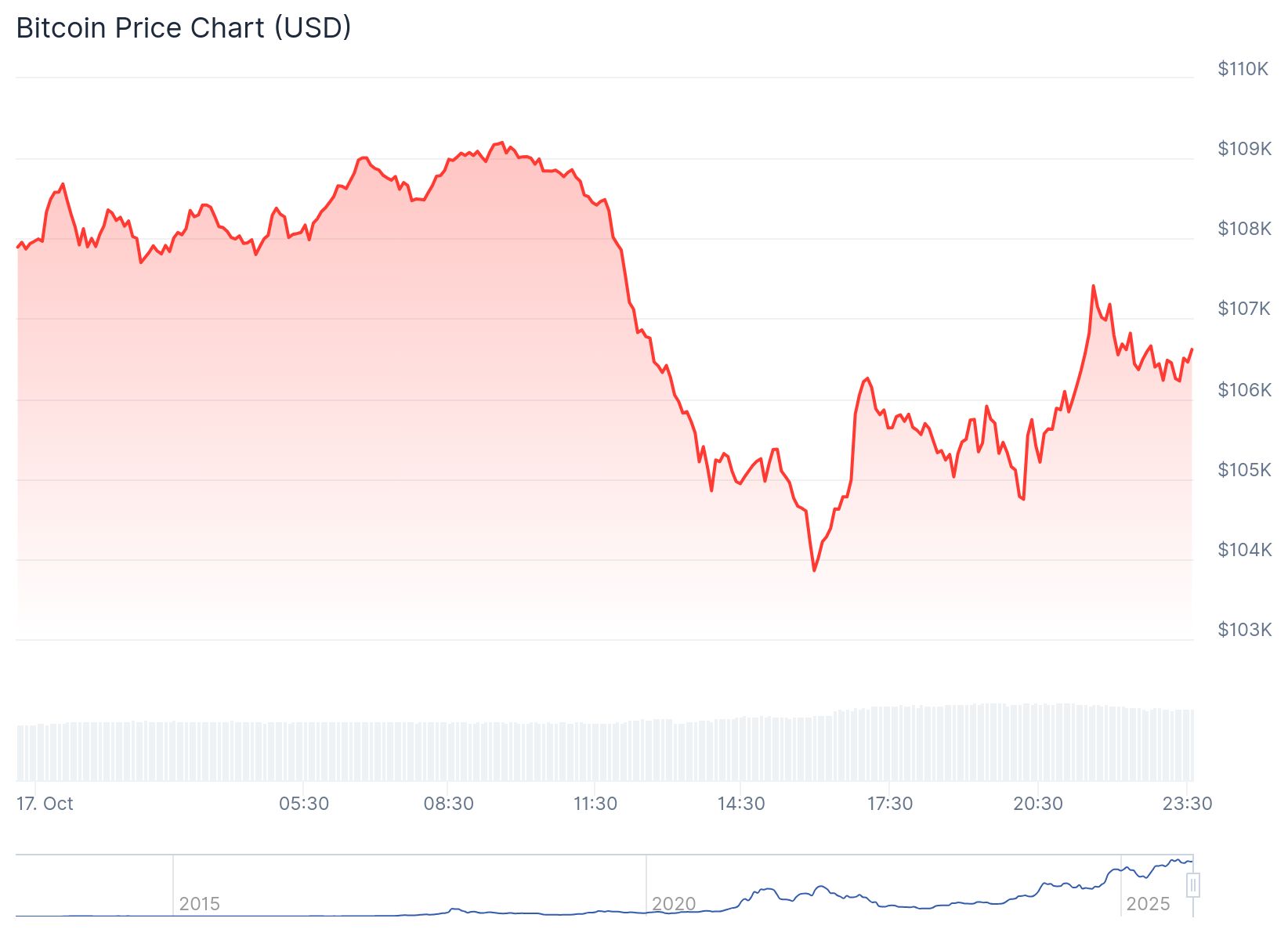

- Bitcoin dropped below $105,000, triggering a broader sell-off in crypto markets and wiping out billions in market capitalization.

- ETF outflows hit $536 million on Thursday, the largest daily loss since August, led by ARK 21Shares and Fidelity.

- The sell-off followed escalating trade tensions between the US and China, including tariffs, sanctions, and harsh rhetoric.

- Analysts point to liquidation events, macro risk, and ETF sentiment shifts as drivers behind the sudden volatility.

What Happened?

Bitcoin’s price dipped below $105,000 on Thursday, as a turbulent week of ETF redemptions and geopolitical friction between the US and China rattled investor confidence. A single-day outflow of more than $530 million from spot Bitcoin ETFs signaled a major sentiment shift, especially after months of consistent inflows.

$128,000,000,000 has been wiped out of the crypto market in just 4 hours.

— Ash Crypto (@Ashcryptoreal) October 17, 2025

Absolute carnage. pic.twitter.com/2PbPmsBinb

ETFs Lead Market Selloff

The 11 US-listed spot Bitcoin ETFs bled $536.4 million in net outflows Thursday, marking the worst day for the segment since early August. The largest hit came from ARK 21Shares Bitcoin ETF (ARKB), which lost $275.2 million, followed by Fidelity’s FBTC with $132 million, Grayscale’s GBTC at $67 million, and BlackRock’s IBIT with $29 million.

🚨 BREAKING

— DANNY (@Danny_Crypton) October 17, 2025

BLACKROCK SELLING $BTC

BINANCE SELLING $BTC

COINBASE SELLING $BTC

IN JUST 6 HOURS, THEY SOLD A TOTAL OF $1.1 BILLION

WHAT’S GOING ON?? pic.twitter.com/OWlVl6TlRX

- Only Tuesday saw net inflows this week, with the rest of the days posting steady outflows.

- Total weekly ETF outflows hit $858.7 million, according to Farside Investors.

- Citi analysts say the drawdown reflects Bitcoin’s increasing correlation with equity markets and broader macro conditions.

Unchained’s latest report noted that ETF options activity has changed the nature of ETF demand, with redemptions now closely tied to market sentiment rather than long-term holding behavior.

Trade War Sparks Panic

Tensions between the US and China escalated dramatically after President Donald Trump announced 100% tariffs on key Chinese imports last Friday. In retaliation, Beijing sanctioned five US-linked subsidiaries and raised maritime fees, sparking investor fears of a renewed trade war.

The back-and-forth led to a dramatic sell-off:

- A $19 billion liquidation event wiped out leveraged crypto positions, the largest in history.

- Bitcoin’s 24-hour low hit $104,853, with a market capitalization drop of 5.9% to $3.64 trillion, the lowest since July.

- Coinmarketcap and CoinGecko reported Bitcoin’s daily decline around 6.3%, with weekly performance down over 10%.

Beijing also accused the US of “deliberately creating unnecessary misunderstanding and panic,” further souring sentiment as both nations prepare for a possible summit later this month.

Broader Market Reaction

The crypto downturn rippled across assets:

- Altcoins fell to multi-week lows, with investors shifting to defensive positions.

- Total futures liquidations reached $227.93 million, led by long positions accounting for $172.27 million.

- Despite the chaos, Citi reaffirmed its year-end Bitcoin target of $133,000, citing overall ETF resilience.

Ganesh Mahidhar of Further Ventures told Decrypt, “There is a short-medium term shift towards a more risk-off state,” pointing to exuberance in risk assets and macro uncertainty ahead of the October 29 FOMC meeting.

CoinLaw’s Takeaway

Honestly, this sell-off felt like a long time coming. In my experience, when ETFs start bleeding and macro headlines dominate the narrative, it’s a sign traders are no longer just betting on crypto fundamentals. They’re reacting to global drama. Bitcoin falling below $105K is dramatic, yes, but not entirely surprising. We’ve seen this movie before: geopolitical chaos, liquidation cascades, and suddenly crypto’s correlation with stocks rears its head. Still, the ETF ecosystem remains young and evolving. This might just be a healthy correction rather than a full reversal.