When Jennifer switched banks, it wasn’t because of a bad experience; it was because her new bank offered predictive financial insights tailored to her spending patterns. This story isn’t unique. Across the United States and globally, customers today expect more than standard banking; they seek personalized, digitally fluent, and emotionally resonant experiences. As banking becomes increasingly commoditized, customer retention has become the cornerstone of competitive differentiation in 2025.

Understanding retention goes beyond tracking attrition. It requires banks to ask: Why do customers stay? What convinces them to leave? And how can loyalty be nurtured in a digital-first environment?

Key Takeaways

- 1The average global banking customer retention rate in 2025 is 82.4%.

- 2Digital-only banks now hold a customer churn rate of just 10.8%, marking the lowest across all banking segments in 2025.

- 3North American retail banks reported an increase in loyalty program usage by 21% in 2025, driven largely by Gen Z.

- 4Customer experience (CX) investments increased by 28% in 2025 across U.S. banks, indicating their growing role in retention strategy.

- 5The average tenure of a customer at a U.S. retail bank is now 8.2 years, showing a stable trend over the past three years.

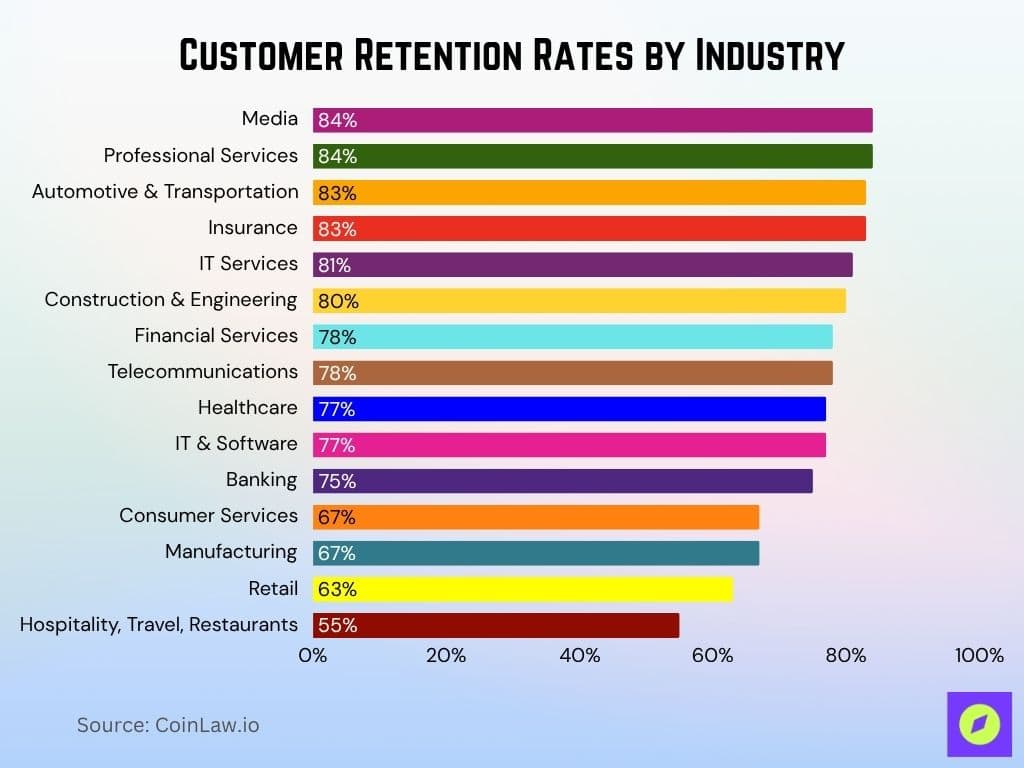

Customer Retention Rates by Industry

- Media and Professional Services top the list with a customer retention rate of 84%, which is 9% above average.

- Automotive & Transportation and Insurance industries closely follow at 83%, marking an 8% increase over the average.

- IT Services holds a strong 81% retention rate, which is 6% above the average.

- Construction & Engineering shows a retention rate of 80%, 5% higher than the average.

- Financial Services and Telecommunications both report a 78% retention rate, 3% above average.

- Healthcare and IT & Software each have a 77% retention rate, 2% higher than average.

- The average customer retention rate across industries is 75%.

- Banking aligns with the average at 75%, showing no change.

- Consumer Services and Manufacturing fall to 67%, which is 8% below the average.

- Retail retains only 63% of its customers, reflecting a 12% drop from the average.

- Hospitality, Travel, and Restaurants have the lowest retention rate at 55%, a significant 20% below average.

Retention Statistics by Bank Type (Retail, Commercial, Digital-Only)

- Retail banks posted a global average retention rate of 80.2% in 2025.

- Commercial banks showed stronger retention at 85.3%, due to long-term lending relationships.

- Digital-only banks improved their global retention rate to 87.9%.

- In the U.S., community banks report a retention rate of 83.1%, bolstered by local engagement strategies.

- Credit unions outperform large retail banks with a retention rate of 86.7% in 2025.

- Investment banks retained 90.4% of institutional clients, showcasing strong account management influence.

Neo-banks in Europe recorded a growth in retention by 3.2%, reaching 82.1% in 2025. - Online-only commercial banks achieved 88.2% retention by integrating smart business finance tools.

- Hybrid banks (those offering both digital and in-branch services) held steady at 82.6% retention.

- Private banks globally maintain a high retention of 91.5% due to premium service tiers.

Key Drivers of Customer Loyalty in Banking

- 24/7 mobile access remains the top loyalty driver for 68% of banking customers in 2025.

- Personalized financial advice influences 54% of customers to stay with their bank.

- Frictionless onboarding contributes to a 19% increase in long-term retention.

- Responsive customer support is cited by 61% of customers as a key loyalty factor.

- Integrated financial wellness tools led to a 17% increase in retention among millennials.

- Trust in data security is the top priority for 72% of customers, directly affecting retention.

- Loyalty rewards programs in banks with gamified elements see 25% higher retention.

- AI-powered fraud alerts improve customer confidence, enhancing retention by 13%.

- Educational content offered through digital platforms boosts loyalty for 47% of Gen Z customers.

- Transparent fee structures have led to a 9% increase in year-over-year customer loyalty metrics.

Digital Banking Satisfaction Levels: Usage vs. Experience

- Digital satisfaction improves as customer sentiment moves from negative to positive.

- Customers who are dissatisfied with digital banking still show a 63% satisfaction level.

- Those who are somewhat dissatisfied report 67% satisfaction.

- Neutral respondents, neither satisfied nor dissatisfied, record a 68% satisfaction score.

- Satisfaction jumps to 72% for those who are somewhat satisfied.

- Customers who are satisfied show a 75% satisfaction level with digital banking channels.

- The highest satisfaction, at 81%, comes from extremely satisfied digital banking users.

- No satisfaction data was recorded for those extremely dissatisfied (value: 0%).

Churn Rates and Common Causes of Attrition

- The average global churn rate for banks in 2025 stands at 17.6%.

- Retail banks in North America experienced a churn rate of 19.2%, primarily due to dissatisfaction with digital interfaces.

- Digital-only banks have the lowest churn at 10.8%, thanks to superior user experience and faster support.

- Top reasons for switching banks in 2025 include high fees (43%), poor customer service (39%), and limited digital features (32%).

- Branch closures in rural areas contributed to a 15% increase in attrition among older demographics.

- Inconsistent omnichannel experiences led to a 7.5% churn rate among Gen Z users.

- Data breaches or security concerns were cited by 28% of customers who left their bank.

- Lack of personalized financial services drove away 22% of small business clients.

- Long waiting times for support (more than 10 minutes) are linked to a 13% higher likelihood of customer churn.

- Inadequate mobile banking features prompted 35% of users to consider switching providers in 2025.

Impact of Digital Banking on Retention

- Digital-first customers exhibit a retention rate of 88.4%, higher than the multi-channel average.

- Mobile banking adoption in 2025 reached 94% among U.S. bank clients under age 40.

- AI-powered digital experiences contributed to a 14% increase in retention across major U.S. banks.

- Banks offering real-time transaction alerts and smart budgeting tools retain 11% more users than those that do not.

- Banks with high app ratings (4.5 stars or higher) on app stores have 9% higher retention on average.

- The integration of digital identity verification reduced onboarding drop-off rates by 31%.

- Seamless cross-platform banking (mobile, tablet, desktop) resulted in a 12% retention increase.

- Banks that use chatbots with human fallback see a 22% boost in digital engagement loyalty.

- Voice-enabled banking services are now used by 21% of U.S. customers and have a 9% uplift in retention.

- Banks with digital gamification features for savings goals have 26% higher engagement and loyalty.

Top Reasons Behind Customer Loyalty

- The product itself is the biggest driver of loyalty, cited by 55% of customers.

- Great deals motivate 25% of customers to stay loyal to a brand.

- Only 7% say customer service is their main reason for loyalty.

- Convenience influences loyalty for 6% of respondents.

- 3% of customers attribute their loyalty to other reasons not listed.

- Supporting a cause or charity matters to 2% of brand-loyal customers.

- Just 1% say they’re loyal because a brand is popular.

Role of Customer Experience in Retention Metrics

- In 2025, 71% of U.S. banking customers say that CX quality is the top reason they remain loyal.

- Banks that score above 85% in CX satisfaction surveys have 2.4x higher retention rates.

- Banks investing in proactive support outreach (before issues arise) retain 18% more customers.

- Real-time feedback mechanisms, such as in-app surveys, drive a 12% increase in loyalty.

- Emotional connection metrics, like trust and respect, now predict retention better than traditional NPS scores.

- Banks offering callback options during high call volumes report a 17% drop in churn.

- CX personalization through customer journey analytics correlates with a 19% retention boost.

- AI-generated insights for advisors help in reducing attrition by 15% in premium service tiers.

- Accessibility enhancements (voice navigation, font size control) improved retention among older customers by 8%.

- Training frontline staff in empathy directly correlates with a 21% increase in satisfaction-led loyalty.

Retention Trends by Region (North America, Europe, Asia-Pacific)

- North America shows a steady retention rate of 81.9%, led by improvements in mobile app usability.

- U.S. regional banks reported a 5% increase in loyalty due to better financial education services.

- Canada saw a slight decline in loyalty to 79.4%, impacted by high fee sensitivity.

- Europe’s retention dropped to 79.6%, with southern countries experiencing the highest churn.

- Germany and the Nordics maintained high loyalty at 86.2%, driven by trust and data transparency.

- Asia-Pacific leads global trends with 85.1% retention, due to strong digital adoption in countries like South Korea and Singapore.

- India experienced a surge in retention, reaching 83.5%, following major fintech-bank partnerships.

- Australia saw gains, with digital banking satisfaction driving retention up to 84.7%.

- Japan’s aging population helped maintain 89.2% retention among seniors, a record high.

- Southeast Asia‘s mobile-first approach led to a 6% year-over-year increase in customer loyalty.

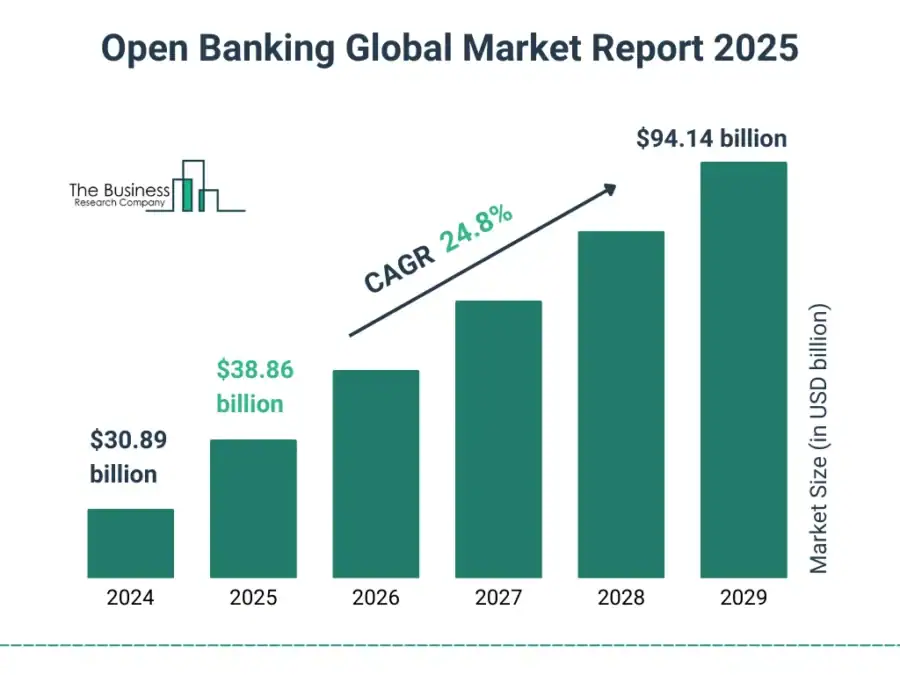

Open Banking Market Growth Forecast

- The global open banking market is projected to grow at a CAGR of 24.8%.

- Market size in 2024 is estimated at $30.89 billion.

- By 2025, the market is expected to reach $38.86 billion.

- Continued growth pushes the market higher through 2026, 2027, and 2028.

- By 2029, the market is forecasted to hit $94.14 billion, more than triple its 2024 size.

This explosive growth highlights increased adoption, regulatory support, and consumer demand for digital financial services.

Effect of Personalization and AI on Customer Retention

- In 2025, banks using AI for personalized insights have a 12.3% higher retention rate than those that do not.

- 71% of customers say customized financial recommendations keep them loyal to their bank.

- AI-driven predictive analytics helped reduce churn by 18% in mid-sized U.S. banks.

- Customers engaging with personalized budgeting tools are 2.7x more likely to remain long-term clients.

- Robo-advisory platforms with tailored investment advice report 89.8% customer retention.

- Behavioral nudges using AI (e.g., savings reminders) led to a 15% retention increase among young adults.

- Banks that dynamically adjust offers using AI models saw a 19% uplift in cross-sell conversions, reinforcing stickiness.

- Voice and chatbot personalization contributed to a 21% increase in retention over generic support bots.

- Customers receiving tailored fraud alerts experienced a 32% increase in trust-based loyalty.

- AI-powered loan pre-qualification tools boosted retention for mortgage clients by 13.5%.

Customer Satisfaction Rankings for Direct Banking (Savings Accounts)

- Charles Schwab Bank leads with a score of 748, the highest in customer satisfaction.

- American Express and Marcus by Goldman Sachs follow closely with 737 and 735, respectively.

- Discover ranks fourth with a score of 718, while Ally scores 715, and SoFi earns 710.

- E*TRADE from Morgan Stanley is slightly below average at 702.

- Capital One scores 699, placing just under the average.

- Barclays and Varo fall lower with 684 and 678, respectively.

- CIT Bank and Synchrony both receive a satisfaction score of 666.

- Citi ranks lowest in the study with a score of 664.

Importance of Omnichannel Banking in Customer Loyalty

- Customers using three or more banking channels are 2.1x more loyal than those using one.

- Banks offering seamless online-to-branch integration increased retention by 14.6%.

- 91% of U.S. banking customers expect the same experience whether they visit a branch or use an app.

- Omnichannel clients in 2025 report a customer lifetime value that is 42% higher than single-channel clients.

- Banks implementing click-to-call from app interfaces improved resolution rates by 27% and boosted loyalty.

- Omnichannel fraud detection systems reduced customer complaints by 22%, strengthening retention.

- Customers using branch appointment scheduling tools are 18% more likely to return for future interactions.

- Banks with cross-channel loyalty programs retained 89% of members in 2025.

- Real-time data synchronization across channels leads to 13% fewer support tickets and improved satisfaction.

- Customer journey continuity (starting online and finishing in-branch) correlates with a 20% retention increase.

Cost of Customer Acquisition vs. Retention in Banking

- In 2025, the average cost to acquire a new banking customer in the U.S. is $390.

- By comparison, the cost to retain an existing customer remains significantly lower at $75.

- Banks investing 20% more in retention strategies report a 32% higher ROI than those focusing on acquisition.

- Customer churn costs U.S. banks an estimated $195 billion annually.

- Increasing retention by just 5% can boost profits between 25% and 95%, depending on the banking product.

- Banks with automated retention outreach saved $1.8 million annually in support and marketing costs.

- The break-even period for acquisition has extended to 18.2 months, making retention even more critical.

- Digital onboarding optimization reduces early attrition and saves $110 per customer on average.

- Customers enrolled in retention-focused loyalty programs make 26% more transactions annually.

- Financial coaching programs for at-risk customers reduce churn-related losses by 15.4%.

Preferred Banking Methods by Age Group

- 60 and older prefer in-person banking (39%), followed by online (31%) and mobile (16%).

- Ages 44–54 show a strong preference for online banking (52%), with mobile (17%) and in-person (9%) far behind.

- Ages 28–43 are the most digital-savvy, with 60% preferring mobile banking, while online (14%) and in-person (4%) lag.

- Those 27 and younger also favor mobile banking (57%), while only 11% use online and 4% choose in-person services.

Recent Developments in Banking Retention Technologies

- Customer data platforms (CDPs) are now used by 62% of U.S. banks to unify retention efforts.

- AI-powered retention scoring models are helping banks preempt churn with 89% accuracy.

- Biometric authentication in apps has led to a 21% increase in customer trust and retention.

- Augmented reality (AR) bank tutorials are being piloted to enhance onboarding and reduce early churn.

- Intelligent CRM integrations now allow real-time updates that improve cross-channel personalization.

- Banks leveraging predictive sentiment analysis from call center audio saw a 16% churn reduction.

- Cloud-native banking platforms reduced downtime and improved retention by 12% among digital users.

- Open banking APIs enabled better third-party app integrations, improving user satisfaction and loyalty.

- Blockchain-based loyalty points are being explored, with pilot programs showing 9.3% higher engagement.

- Digital twins of customer profiles are used to simulate retention strategy outcomes, reducing risk.

Conclusion

Customer retention in banking has matured from reactive support to proactive, data-driven engagement. In 2025, banks are not only expected to meet functional expectations but also to understand and anticipate customer needs with surgical precision. Technologies like AI, personalization, and omnichannel interfaces are no longer optional; they are the linchpins of sustainable customer loyalty.

Those institutions that can foster trust, tailor experiences, and simplify financial decision-making will be the ones to thrive. As competition intensifies and acquisition costs rise, the message is clear: retaining the customer is no longer just good business, it’s the best business.