In a bustling Manhattan branch of a major U.S. bank, a loan officer now spends her mornings reviewing AI-generated insights instead of stacks of paperwork. Around her, clients chat with intelligent virtual assistants and approve transactions using facial recognition. What once sounded futuristic is now the new normal. Artificial Intelligence (AI) isn’t just an upgrade; it’s a transformation reshaping every corner of the banking world.

From fraud prevention to real-time customer service, AI adoption in banking has surged in 2025, turning traditional institutions into smart, data-driven powerhouses. This article offers a deep dive into the numbers and trends that show how AI is revolutionizing the global financial ecosystem.

Editor’s Choice

- 92% of global banks reported active AI deployment in at least one core banking function as of early 2025.

- The banking sector is projected to spend over $73 billion on AI technologies by the end of 2025, marking a 17% year-over-year increase.

- AI-based fraud detection systems are reducing false positives by up to 80% in major U.S. banks.

- Chatbots now handle 70% of Tier 1 customer queries across top North American financial institutions.

- AI-driven credit risk modeling has improved loan approval accuracy by 34% in mid-size banks.

- 54% of all customer interactions in U.S. banks are now fully automated through AI-driven systems.

- AI is expected to contribute $1.2 trillion to the global banking industry’s bottom line by 2030, with 2025 marking the inflection point for scaled ROI.

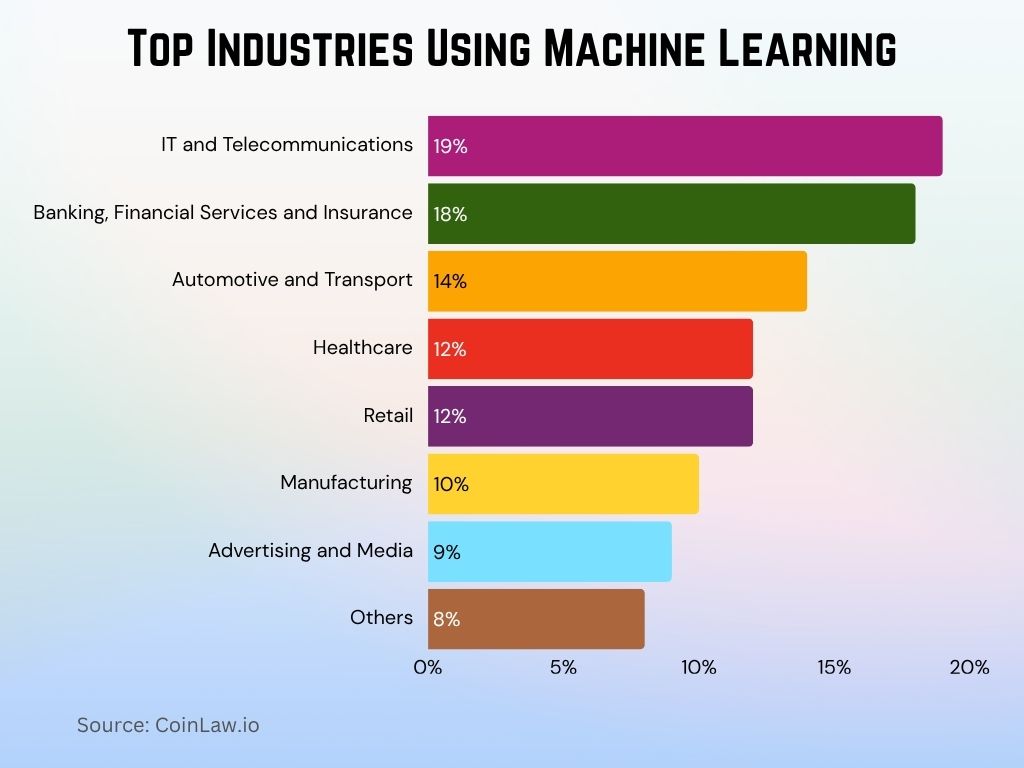

Top Industries Using Machine Learning

- IT and Telecommunications lead the way with 19% machine learning adoption, showcasing strong reliance on AI for automation and optimization.

- Banking, Financial Services, and Insurance follow closely at 18%, using ML for fraud detection, credit scoring, and risk management.

- Automotive and Transport contribute 14%, reflecting ML’s role in autonomous driving and predictive maintenance.

- Healthcare and Retail are tied at 12% each, with ML enhancing diagnostics, patient care, and personalized shopping experiences.

- Manufacturing stands at 10%, adopting ML for process efficiency and defect detection.

- Advertising and Media use ML at 9% to power targeted content and recommendation engines.

- Other industries make up 8%, showing growing but niche applications of ML.

Global Adoption Rates of AI in Banking

- In 2025, North America leads in AI adoption in banking, with 98% of institutions using AI for at least one operational process.

- Asia-Pacific banks saw a 21% increase in AI investments year-over-year, with India and Singapore driving regional growth.

- In Europe, 86% of banks have integrated AI into compliance, fraud detection, or customer service systems.

- African banks reported a 60% AI implementation rate in mobile banking and digital onboarding solutions.

- Latin America witnessed a 44% rise in AI adoption in retail banking, particularly in credit scoring and chatbot services.

- Over 65% of global financial institutions now utilize machine learning algorithms for portfolio management and trading insights.

- Banks in the Middle East have tripled their AI budget allocation compared to 2023, focusing primarily on cybersecurity and AML (Anti-Money Laundering).

- 43% of small banks and credit unions globally have started AI pilot programs in 2025.

- 76% of global bank executives surveyed said AI adoption is now critical for competitive survival.

Impact of AI on Banking Efficiency and Cost Reduction

- AI automation has helped reduce operational costs by an average of 13% across major U.S. banks in 2025.

- Banks report a 25% faster loan processing time with AI-driven underwriting systems.

- AI-backed automation in back-office operations has decreased processing errors by 45%.

- Implementation of AI in compliance monitoring has cut audit preparation times by 35%.

- Digital customer onboarding via AI now takes under 4 minutes, compared to 20+ minutes in manual workflows.

- AI-based document processing has reduced paper-based verification processes by 90% in mid-tier banks.

- AI chatbots have contributed to a 32% drop in call center volume, leading to significant savings in operational staffing costs.

- Predictive analytics in AI tools has improved customer retention rates by 12%, reducing churn-related expenses.

- Banks deploying AI for process optimization have seen an average ROI of 3.5x within 18 months.

- In 2025, institutions using AI to manage energy consumption in data centers achieved 20% savings in infrastructure costs.

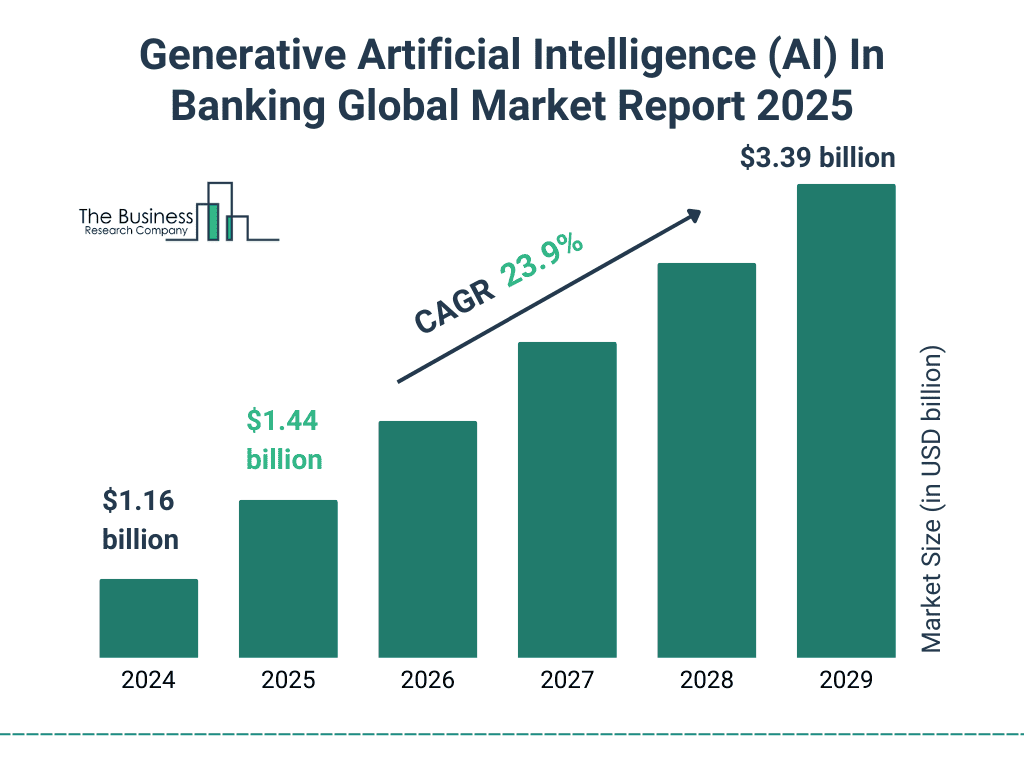

Generative AI in Banking: Global Market Growth Outlook

- The Generative AI market in banking is projected to grow from $1.16 billion in 2024 to $3.39 billion by 2029.

- The market is expanding at a compound annual growth rate (CAGR) of 23.9%.

- In 2025, the market is expected to reach $1.44 billion, showing strong year-over-year growth.

- By 2026, it will surpass $1.8 billion, continuing its upward trajectory.

- Growth accelerates in 2027 and 2028, reflecting increasing adoption across financial institutions.

- The 2029 forecast highlights a significant leap, hitting $3.39 billion, nearly 3x the 2024 value.

AI-Powered Fraud Detection and Risk Management

- AI-driven fraud detection systems are now in use by 87% of global financial institutions.

- In 2025, these systems are intercepting 92% of fraudulent activities before transaction approval.

- U.S. banks report that AI has reduced false fraud alerts by up to 80%, enhancing the customer experience.

- Real-time fraud detection using AI has led to a 41% drop in financial losses due to cyberattacks.

- AI tools analyzing behavioral biometrics helped detect identity theft cases 28% faster than traditional systems.

- Banks using AI for anti-money laundering (AML) compliance saw a 55% reduction in suspicious activity report (SAR) backlog.

- AI in risk assessment has enabled a 40% improvement in early-warning systems for loan defaults.

- Machine learning models are now used by over 60% of credit risk teams to dynamically adjust risk thresholds.

- AI-assisted due diligence tools have slashed KYC review times by 50%.

- Cybersecurity frameworks embedded with AI have helped reduce security breaches by 37% across multinational banks.

AI Usage in Credit Scoring and Loan Underwriting

- AI is now involved in over 70% of loan underwriting decisions among top-tier U.S. banks.

- AI-enhanced credit scoring models have increased loan approval rates for underbanked individuals by 22% in 2025.

- Machine learning has helped reduce loan processing time to less than 6 minutes in digital-only banks.

- Real-time income verification through AI tools is used by 60% of personal loan providers.

- Banks employing alternative data models via AI have decreased loan defaults by 18%.

- Over 85% of fintech lenders use AI to adjust lending criteria dynamically based on real-time borrower behavior.

- AI-based risk engines are reducing manual intervention in underwriting by up to 90%.

- U.S. neobanks using AI for small business loan underwriting report a 28% faster turnaround time.

- Credit scoring algorithms trained on diverse data sets have lowered gender and racial bias by approximately 12%.

- AI systems now provide lenders with real-time explainability for automated credit decisions, critical for regulatory transparency.

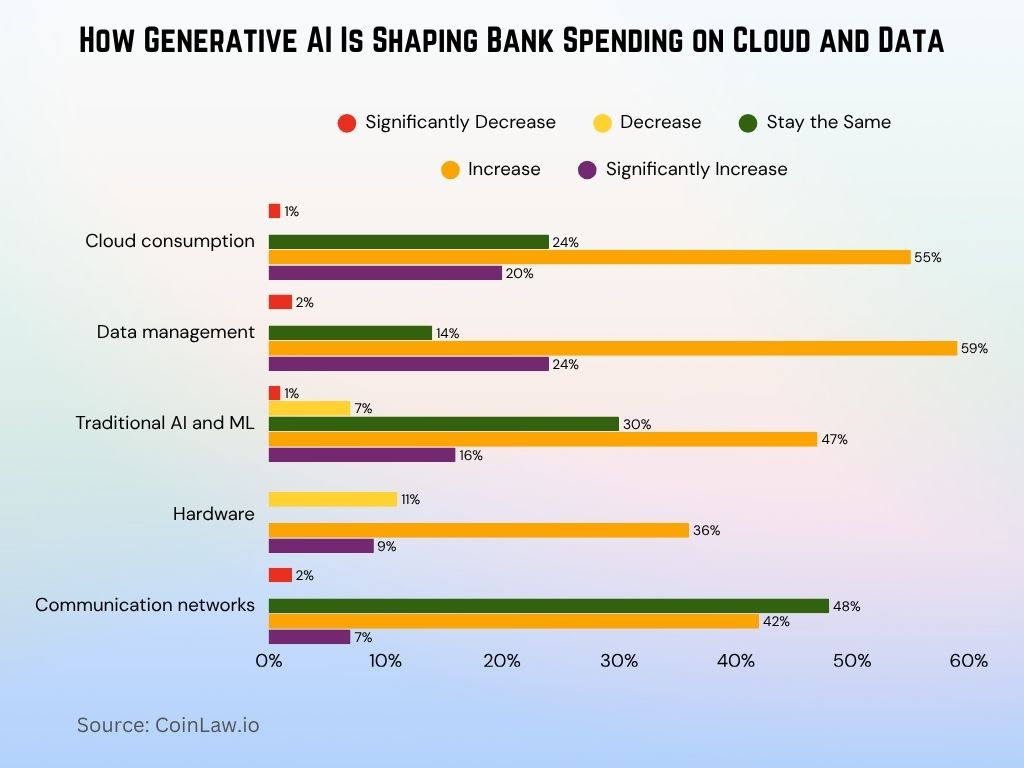

How Generative AI Is Shaping Bank Spending on Cloud and Data

- Cloud consumption spending is rising fast, with 55% of institutions increasing and 20% significantly increasing their budgets.

- For data management, 59% reported an increase, and 24% saw a significant increase, making it the top area of growth.

- Traditional AI and machine learning investments are also growing, with 47% increasing and 16% significantly increasing their spend; only 1% significantly decreased.

- Hardware spending is seeing more moderate growth, 36% increased, and 9% significantly increased, while 11% actually decreased their investment.

- Communication networks spending remains steady for most, with 48% reporting no change, but 42% still noted an increase, and 7% a significant increase.

Investment Trends in AI for Financial Institutions

- Global banks are projected to invest $73.4 billion in AI technologies by the end of 2025.

- The average AI budget for the top 10 U.S. banks has increased by 21% year-over-year.

- AI startups focusing on finance have secured $9.2 billion in VC funding in the first half of 2025 alone.

- Mid-size banks have ramped up investment in AI-based cybersecurity, with spending up 31% compared to 2024.

- Investment in Explainable AI (XAI) models rose by 39%, reflecting heightened compliance needs.

- Banks are dedicating 16% of their IT budgets to AI deployment and experimentation in 2025.

- Strategic partnerships between banks and AI tech firms have grown by 26%, focusing on co-development and IP sharing.

- AI research and development teams within financial firms grew by 15%, as firms prioritize in-house innovation.

- Blockchain-AI hybrid use cases saw a 27% funding increase, mainly in cross-border payment solutions.

- ESG-focused AI tools for investment and lending decisions received over $2 billion in global institutional backing this year.

AI-Driven Chatbots and Virtual Assistants in Banking

- AI chatbots are handling 70–85% of inbound queries for retail banks in North America in 2025.

- Chatbot resolution accuracy rates have reached 91%, significantly improving customer experience.

- Virtual banking assistants are now integrated across 95% of mobile banking apps in the U.S.

- Banks using voice-enabled bots have reduced call center costs by an average of 35%.

- Conversational AI is capable of processing banking requests in over 120 languages, including regional dialects.

- AI assistants are now offering product recommendations with a 27% success rate.

- AI bots assist with identity verification and onboarding for over 38% of new digital accounts.

- Human fallback escalation rates have dropped below 12%, thanks to improved natural language processing (NLP).

- AI virtual agents now support omnichannel banking, including apps, websites, and wearable devices.

- The average cost savings per chatbot interaction is estimated at $0.72, delivering high-volume ROI across institutions.

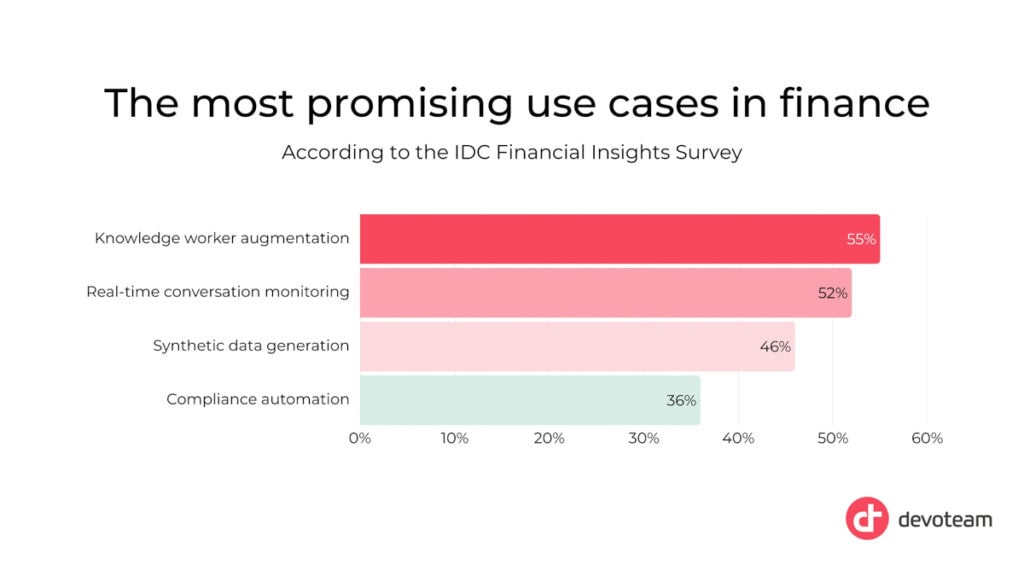

Top AI Use Cases in Finance

- Knowledge worker augmentation is the leading use case, cited by 55% of respondents as the most promising.

- Real-time conversation monitoring closely follows at 52%, highlighting AI’s role in compliance and customer service.

- Synthetic data generation is seen as valuable by 46%, supporting model training and privacy.

- Compliance automation ranks fourth, with 36% identifying it as a key area for AI-driven efficiency.

Regulatory Compliance and AI Integration

- In 2025, 89% of banks report using AI to monitor regulatory compliance in real time.

- Natural language processing tools are helping automate regulatory reporting with 98% accuracy.

- AI has decreased compliance-related costs by an average of 19% across global financial institutions.

- AI-driven surveillance systems now flag suspicious activities 40% faster than traditional systems.

- Regulatory bodies in the EU and the U.S. now recommend the use of Explainable AI (XAI) for high-risk decisions.

- Banks using AI in compliance processes reported a 15% drop in audit findings.

- AI has accelerated the reconciliation of transactions and records, reducing backlogs by 50%.

- Automated AI systems help maintain audit trails, enabling faster investigation and traceability.

- Compliance teams now spend 30% less time on manual reviews due to AI-assisted document analysis.

- AI is increasingly being used to simulate stress testing and scenario analysis under various regulatory conditions.

Regional Insights: AI Penetration in Banking Across Key Markets

- United States banks lead globally, with 99% AI implementation in at least one major banking operation in 2025.

- In China, major banks report 90% integration of AI in fraud detection, lending, and customer service.

- India’s top private banks have increased AI spend by 34%, especially in mobile banking infrastructure.

- UK banks report a 75% usage rate of AI for compliance monitoring and chatbot integration.

- In Germany, over 60% of regional banks are piloting AI systems for predictive risk management.

- Brazilian banks expanded AI deployment by 40% year-over-year, driven by digital banking transformation.

- South Korea’s financial sector is using AI in robo-advisory tools that now serve over 4 million customers.

- Canada saw a 23% increase in AI penetration, particularly among credit unions and digital-first banks.

- Middle Eastern banks, particularly in the UAE and Saudi Arabia, now use AI for Sharia-compliant finance operations.

- In Australia, 85% of banks reported that AI is instrumental in mobile-first strategies and anti-fraud frameworks.

Where Banks Are Using AI to Enhance Customer Experience

- 75% of banks use AI on websites, email, and chat to deliver faster, more personalized digital interactions.

- 53% implement AI in physical customer interaction points, bridging digital tools with in-branch service.

- 52% leverage AI in mobile apps, optimizing real-time services and user journeys.

- 45% deploy AI on social media for engagement, sentiment analysis, and brand management.

- 44% apply AI in customer support, improving resolution times and response accuracy.

- 36% use AI in voice interfaces, enabling smarter virtual assistants and voice banking features.

Workforce Transformation and AI’s Role in Banking Employment

- Up to 11% of traditional banking roles have been automated by AI systems in 2025, primarily in back-office tasks.

- AI-related roles in banks, like data scientists and machine learning engineers, grew by 29%.

- Banks retrained over 420,000 employees globally to work alongside AI tools and platforms.

- AI has enabled customer service agents to handle 3x more cases per day using augmented intelligence systems.

- 40% of HR departments in banks now use AI for recruitment, reducing time-to-hire by 50%.

- AI-powered learning platforms are used by 70% of global banks for upskilling initiatives.

- Leadership roles that involve AI strategy have increased by 18%, especially in CIO and CDO functions.

- In retail branches, AI kiosks have reduced the need for entry-level tellers by 35%.

- Employee satisfaction scores rose by 16% in banks with successful AI-human collaboration environments.

- Banks with high AI maturity report 20% lower attrition rates, credited to better role clarity and training.

Challenges in Implementing AI in Banking Systems

- 47% of banks cite legacy infrastructure as the top barrier to AI scalability in 2025.

- Regulatory uncertainty remains a key challenge, particularly for cross-border AI models.

- Data privacy concerns have slowed down AI rollout in 32% of EU-based institutions.

- Bias in AI algorithms is under regulatory scrutiny, especially in lending and credit scoring.

- Banks struggle with the shortage of skilled AI talent, leading to a 24% gap in data science hiring needs.

- Interoperability issues between AI and traditional core banking systems continue to hinder full integration.

- Nearly 30% of AI pilot projects in banks do not proceed to production due to unclear ROI.

- AI model governance frameworks are still evolving, leading to fragmented compliance reporting.

- There’s growing concern over the “black box” nature of AI, with 41% of bank executives calling for transparency reforms.

- Small and community banks cite cost constraints as a major barrier to AI adoption, even for basic automation.

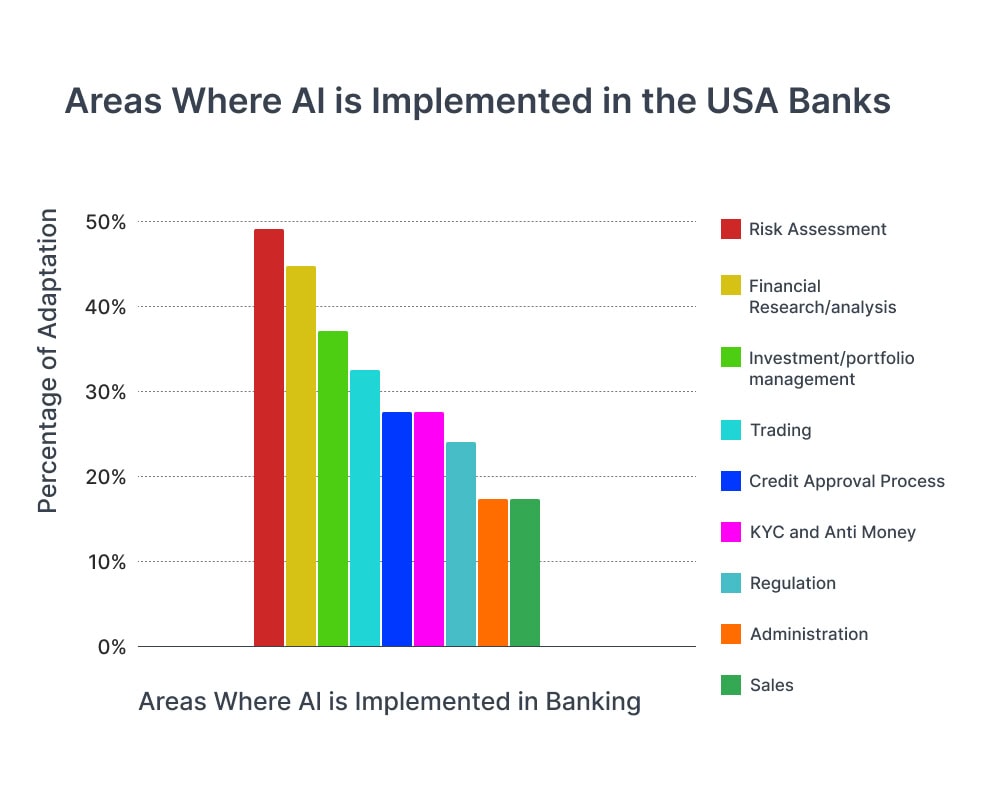

Key Areas Where AI Is Adopted in U.S. Banks

- Risk assessment leads AI implementation with 49% adoption, helping banks predict defaults and minimize financial exposure.

- Financial research and analysis follow at 45%, where AI assists in data-driven investment decisions.

- Investment and portfolio management sees 37% AI use, boosting personalized financial planning.

- Trading leverages AI at 33%, enhancing speed and accuracy in market execution.

- Both credit approval and KYC/anti-money laundering functions report 28% AI usage for compliance and fraud detection.

- Regulatory processes are supported by AI in 25% of banks.

- Administration and sales trail with 18% adoption each, showing emerging but limited AI use in these areas.

Recent Developments in AI Applications in Banking

- Generative AI is being deployed for intelligent document processing, slashing onboarding times by half.

- AI copilots for financial advisors are gaining traction, enabling real-time portfolio suggestions and rebalancing.

- Top U.S. banks are using LLMs (large language models) for real-time analysis of regulatory updates and news.

- Banks now use predictive AI to detect early signs of financial distress in corporate clients.

- AI-enhanced cyber defense systems now include autonomous response capabilities, minimizing breach impact times.

- Emotion AI is being tested in customer calls to detect distress and direct high-sensitivity cases to human agents.

- Real-time market sentiment AI tools are used in treasury operations for adaptive trading strategies.

- AI-powered sustainability scoring systems are helping banks align with ESG investment mandates.

- Digital twins of banking operations powered by AI are being used for scenario simulation and planning.

- AI voice authentication is now used by 67% of mobile-first banks to secure access and prevent fraud.

Conclusion

AI’s grip on the banking industry in 2025 is no longer theoretical; it’s deeply operational. From personal finance assistants in your pocket to algorithms scanning global transactions for fraud, AI has evolved from a competitive edge to a foundational element of modern banking. Institutions that once hesitated are now racing to integrate AI not only to cut costs but also to enrich customer interactions and uphold compliance.

Yet, as with any transformative shift, the journey comes with challenges. Ethical AI use, regulatory clarity, and workforce adaptation will define the next chapter. One thing is clear: the banks of tomorrow will not only run on code, they’ll think with it.